June FOMC Meeting Recap

Comments Commentary on the FOMC’s June meeting continued the recent trend of focusing on the timing and extent of rate cuts while forsaking the possibility of other outcomes. Namely that the next Fed move is more likely to be a rate increase than a cut. The first indication that rate increases are on the table, even if Powell is loath to admit so, is the strong and steady pace of final demand (Chart 1). If policy was as restrictive as Powell insists, there would be signs of this showing up in the employment and/or final demand date, but there is scant evidence of a slowdown to be found.

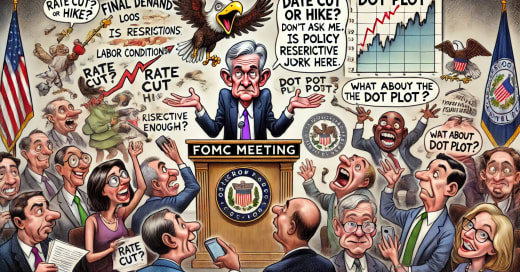

Powell’s answer to a question on whether policy is as restrictive as the FOMC thinks was telling because he answered that policy is definitely restrictive, but whether it is sufficiently restrictive can only be discovered with the passage of time. Although he spent a good number of words trying to talk around the reporter’s question, he eventually got around to validating the question without answering it. Indeed, the theme of the press conference is best described as “Powell Shrugged”. The Chairman’s answers to many questions about likely future outcomes amounted to “Don’t ask me, I just work here.”

Powell made the point, likely correct, that the first cut would bring with it a substantial easing of financial conditions. What he left out of his answer was that conditions are already loose and getting looser (Chart 2). The upshot being that if/when the market realizes that another round of rate increases is a very real possibility there will be a substantial tightening of conditions. This is the essence of the stop-go policy of the 1970s, the central bank is unhappy with inflation outcomes but would rather accommodate the inflation than live with the consequences of adequate tightening.

Powell continues rely on labor market conditions to prop up his argument that the economy has further painless disinflation to offer. In this writer’s opinion, Powell’s comments during the press conference had an air of wishful thinking to them. The Chairman raised the possibility that rising labor force participation could continue to provide the workers demanded by the economy without inflation rising. However, prime age labor force participation is less than one percentage point away from the all-time peaks seen in the late 1990s (Chart 3). Looking to participation for salvation is folly.

The Chairman also made the comment that labor market conditions have returned to the reigning conditions in 2019, tight but not overheating. This writer has made largely the same point in recent notes on the labor market, but my research included an important caveat that the Chairman neglected to include. Conditions in the labor market are no longer overheating but idle capacity is essentially non-existent, which was not the case in 2019 (Chart 4). The labor market is not currently overheating, but the smallest push is all that is needed to tip the economy into a state of overheating again.

Finally, there are the dot plot and summary of economic projections. These were emergence measures rolled out to allow the Fed to influence the shape of the yield curve under extraordinary circumstances. The post-crisis communication strategies the Fed adopted are the epitome of expediency. The diminished usefulness of these tools was on full display during the press conference. Time and time again reporters asked for clarification about the mundane details of the projections and placed an undue importance on the few data points included. Powell’s frustration was on full display and more than once the Chairman got close to saying something to the effect of “These are just guesses we use for drinking games!”

The dot plot does not provide a useful indicator of the stance of future policy, but it does provide useful insight into the state of discussion on the committee. As mentioned above, the media focused on the number of cuts that could be inferred from the dot plot while missing the larger story. Expectations among FOMC participants are indeed currently centered around 1-2 cuts in 2024. However, the more important insight to draw from the dot plot is that rate expectations have been steadily migrating higher and expectations for more than two cuts have completely disappeared.

The battle lines are becoming clearer as the conflict between the hawks and the doves draws nearer. Soon, the hawks will begin pushing for rate increases to be brought back onto the table as a potential option. The doves, especially the Biden four, will give up on rate cuts but will fight to keep rate increases off the table. The best tool they have available to fight this battle is likely the dot plot. By holding their line in rate cut territory they can shape the discussion in the financial media, which caters to the banking and speculative community and, as a result, cheerleads for loose policy at every opportunity.