· October saw the effects of expectations for the Fed’s next rate hike play out with short-term rates rising and long-term rates locked in place. The result was that the front of the curve flattened significantly (Charts 1 & 2).

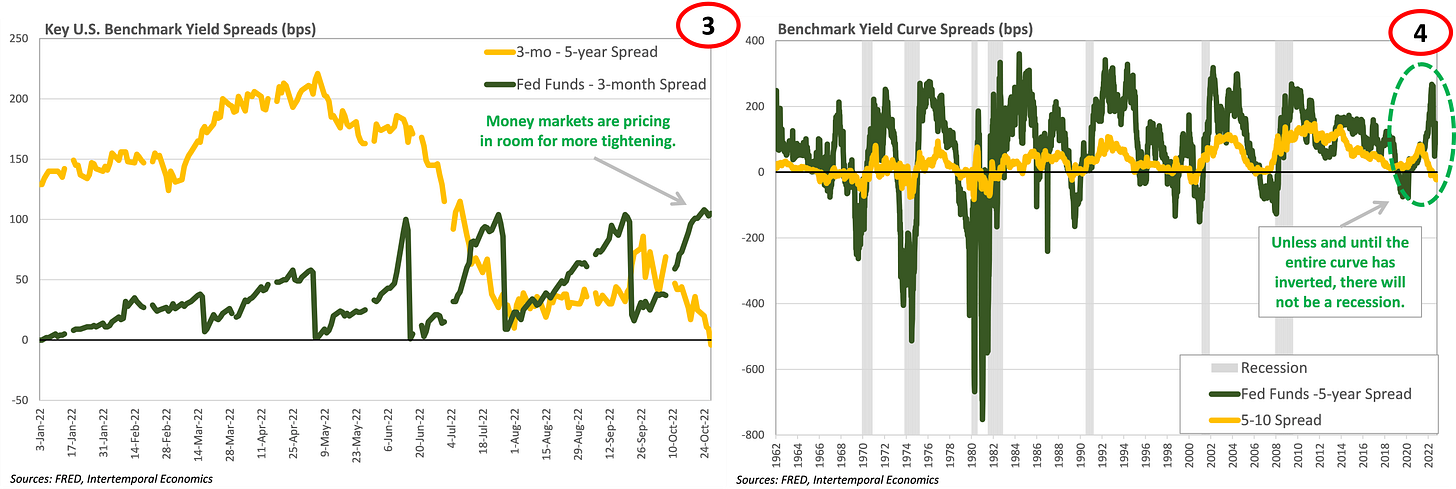

· Money markets are pricing in a cushion of 25 basis points on top of the expected 75 basis point hike (Chart 3). The Fed has room to work with before the curve becomes inverted, but not much.

· The reason the action at the front of the curve has become so important is that no recession has occurred during the post-war period without the entire curve being inverted (Chart 4). Many have taken recent action along the yield curve as “indicating” a recession using spreads that act as a rule of thumb – 2s10s, 5s30s, etc. This is a mistake because the shape of the yield curve causes changes in economic activity.

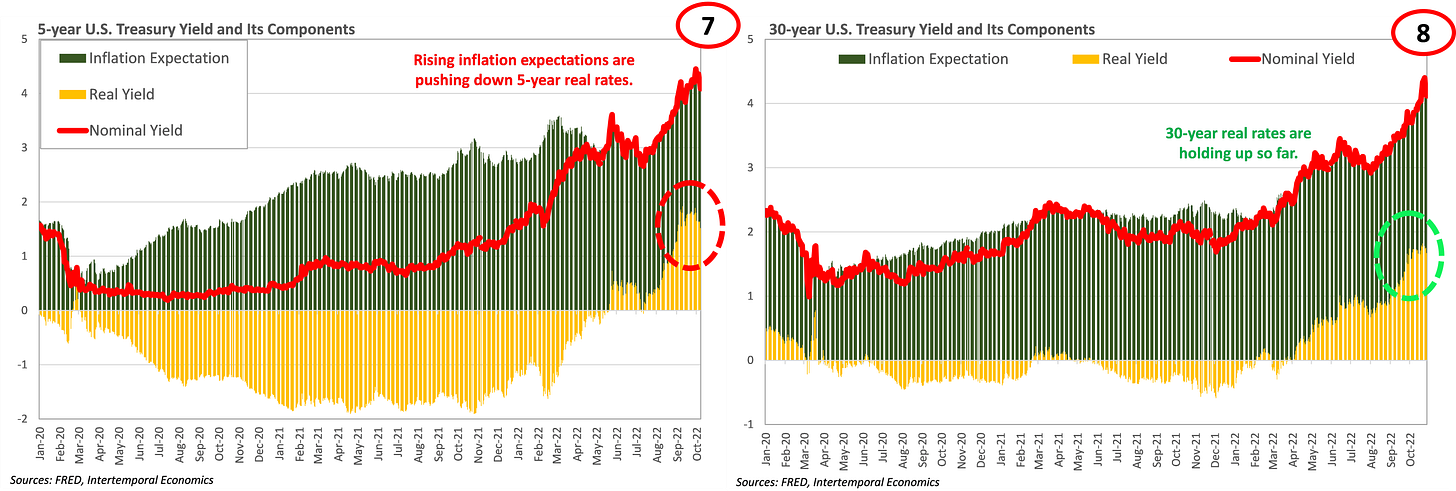

· Another bad sign for the Fed is the recent top in real interest rates (Charts 5 & 6). Real rates, rather than nominal rates, are the measure that matters for economic activity. Concerns about low inflation after the 2008 financial crisis led to an obsession with nominal rates, but those days are over. Right now, the Fed needs real interest rates to continue rising in an orderly manner that maintains an upward sloping yield curve.

· Rising inflation expectations have outpaced nominal rates for maturities below five years. Real rates at the back end of the curve are holding up but will likely require Yield Curve Control to continue rising (Charts 7 & 8).

Global Real Interest Rates

· Major central banks around the world are raising policy rates but inflation everywhere has been outpacing the tightening, as is the case in the U.S. (Charts 9 & 10). The global trend of falling real interest rates means globally monetary policy has been getting looser since 2021 (Chart 11).

· With policy stimulative around the world, policy tightening in any one economy will not be enough to quiet inflation in that country. Of course, the one possible exception to that logic would be the U.S. because of the role of the dollar in the global economy. In recent months the policy rate in the U.S. has become less negative so the global economy is about to face its first strength test (Chart 12).

· Financial conditions in the U.S. have gotten tighter but are not yet tight, which implies credit will continue flowing to the economy (Chart 13). Until an inversion of the yield curve triggers a change in the situation the U.S. economy will not enter a recession.

· Further bolstering the view that financial conditions are not seizing up is the fact that corporate credit spreads have not blown out. Spreads are higher now than they were a year ago, but they have not breached resistance level of 240 basis points (Chart 14).