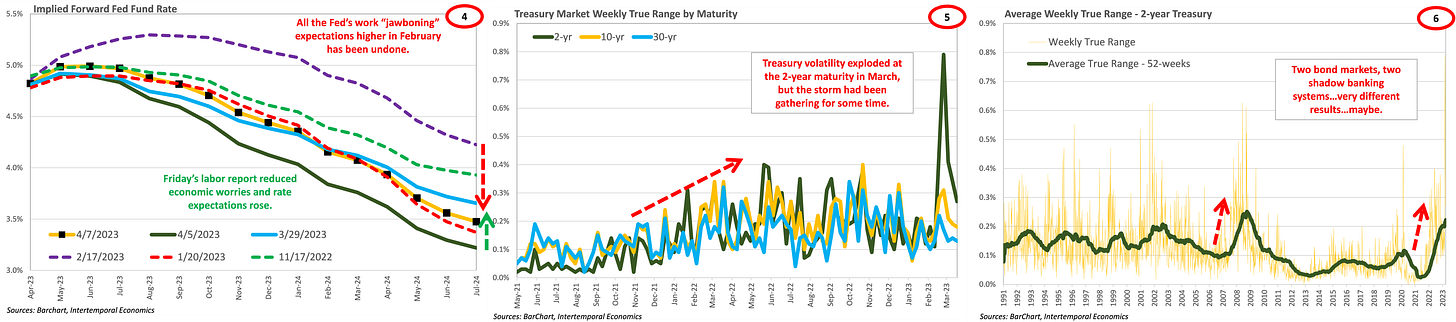

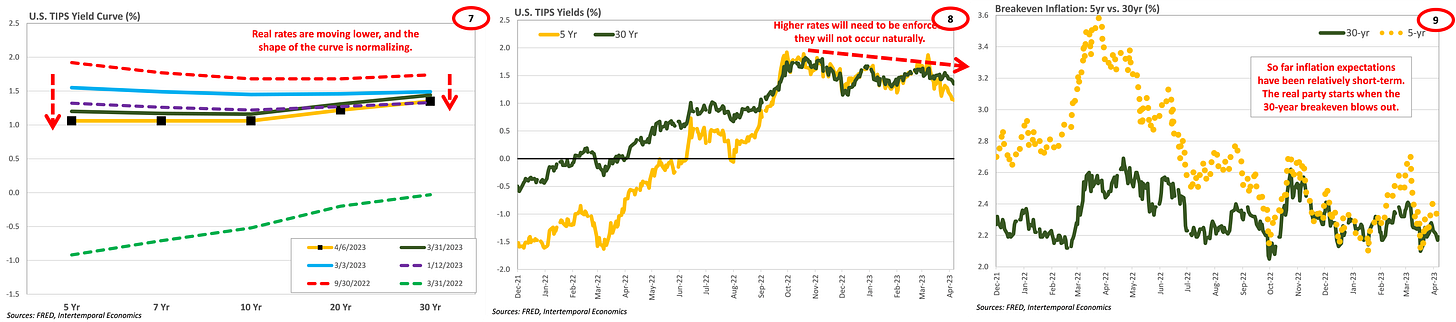

U.S. Bond Markets

· The source of “disinflation” might have unveiled itself as Fed Board member Lisa Cook, gave a speech last week that featured the word prominently. Cook is an unabashed proponent of racially conscious monetary policy and has clearly been making noise over the issue in FOMC meetings. If she is the driving force behind Powell’s “disinflation” narrative, then it points to the force of her views on the committee.

· As Powell said in the last press conference, the FOMC is betting that recent banking turmoil will provide the monetary tightening that the Fed would rather not. That remains to be seen as the rush to avoid a crisis has left the fate of the crypto shadow banking system in doubt.

· If all deposits or the crypto shadow banks are brought under the public umbrella, watch for credit growth and inflation to return in a period of a few quarters. The Fed and the other central banks want the crypto bubble to slowly deflate and for other sectors of the economy to stand still while it happens. If that happy outcome does not occur, they will be forced to choose between expanding the money supply or allowing an asset liquidation to occur.

· Board member Christopher Waller’s recent discussion on the Phillips curve is particularly instructive of the intellectual corner the Fed finds itself in.

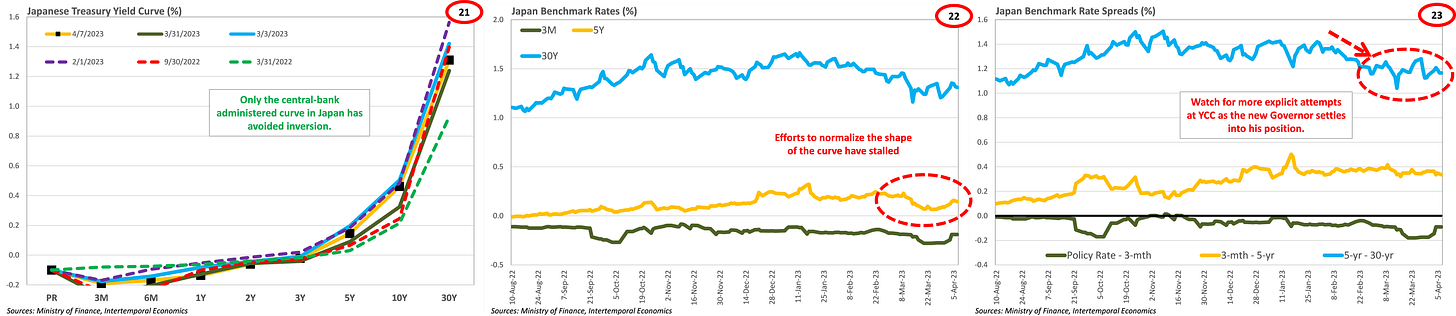

G-7 Bond Markets

· Sagging back-ends are dogging the central banks of the world – and yield curve inversion is a problem too - and they are addressing the issue with a lot of talk about “persistence” and “getting the job done”.

· At the BoE, Andrew Bailey is emphasizing the need to keep policy tight while the supply issue works itself out. That sounds encouraging, but he treats the supply issue as exogenous to monetary policy.

· ECB Executive Board Member Isabel Schnabel gave a refreshingly frank discussion on the difficulty tightening policy with QT, given changes in the structure of the banking system since being flooded with reserves. As she says “years of large excess reserves have blurred our understanding of banks’ underlying demand for liquidity. The aggregate level of reserves has been largely determined by the quantity of asset purchases rather than by banks’ liquidity choices.”

· As the Bank of England and the Fed have found separately in the space of six months, draining liquidity after asset purchases has a funny way of causing financial crisis in non-bank areas that spread to banks very quickly. Watch for an ECB answer to the Fed’s BTFP facility, which is a form of soft YCC. Slowly but surely the central banks will become the market markers of first resort for sovereign bond markets.