U.S. Bond Markets

· Yesterday’s CPI data continued the trend of decelerating inflation, boosting investor confidence a “soft landing” is at hand. Readers of my work will not be surprised by slowing inflation because the relationship between Chinese factories, U.S. factories, and U.S. consumers remains as close as ever (Charts 1 & 2). Expect several months of disinflation that never quite gets back to 2% before another blast of inflation hits.

· Developments along the yield curve have been outright bad for the Fed. The front of the yield curve remains a servant of the Fed, but the back end of the curve is not so well behaved (Chart 3). Members of the FOMC, most notably Powell, have been trying to “talk up” long-term yields by promising rates will be higher for longer.

· Bond markets have not bought the what the Fed is selling on monetary policy and long-term bond yields have been trending down since the break on November 10th when Biden declared victory over inflation (Chart 4).

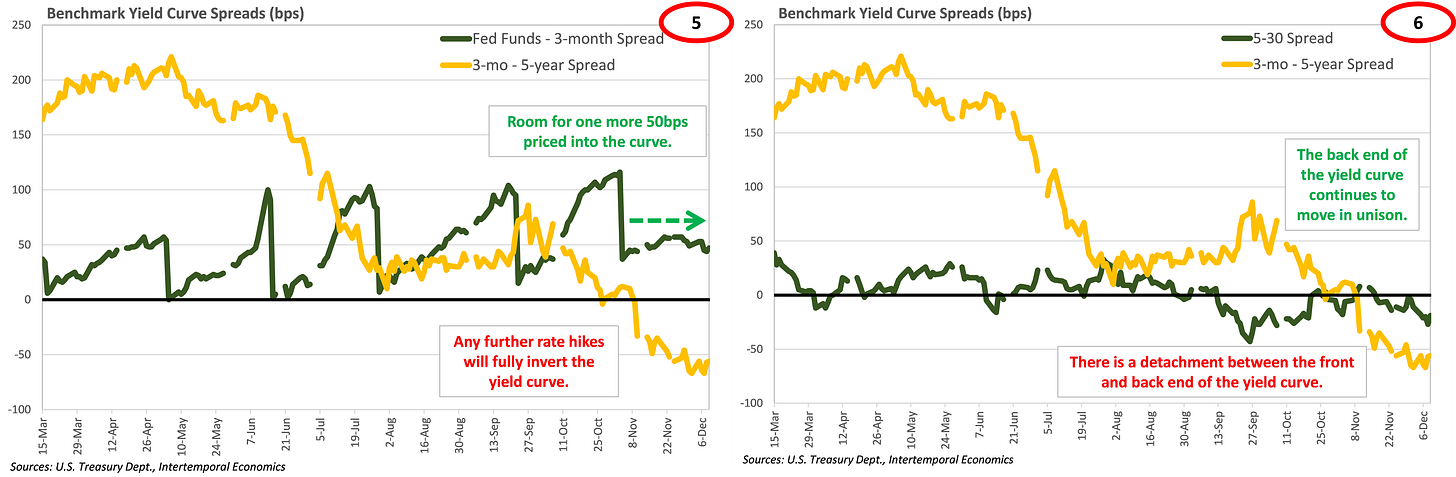

· The Fed only has 50 basis points of tightening left before the entire yield curve is inverted (Charts 5 & 6). There might be some relief from the pain as a result of deposit rates being so low, but the economy is bound to slow down in the face of an inverted curve.

· The bond market is sending indications that lower growth is expected over the long run because the fall decline in nominal rates has been driven by declining real rates (Charts 7-10). Real rates tell us how much growth the bond market expects, and inflation expectations tell us about expected inflation resulting from that rate of real growth.

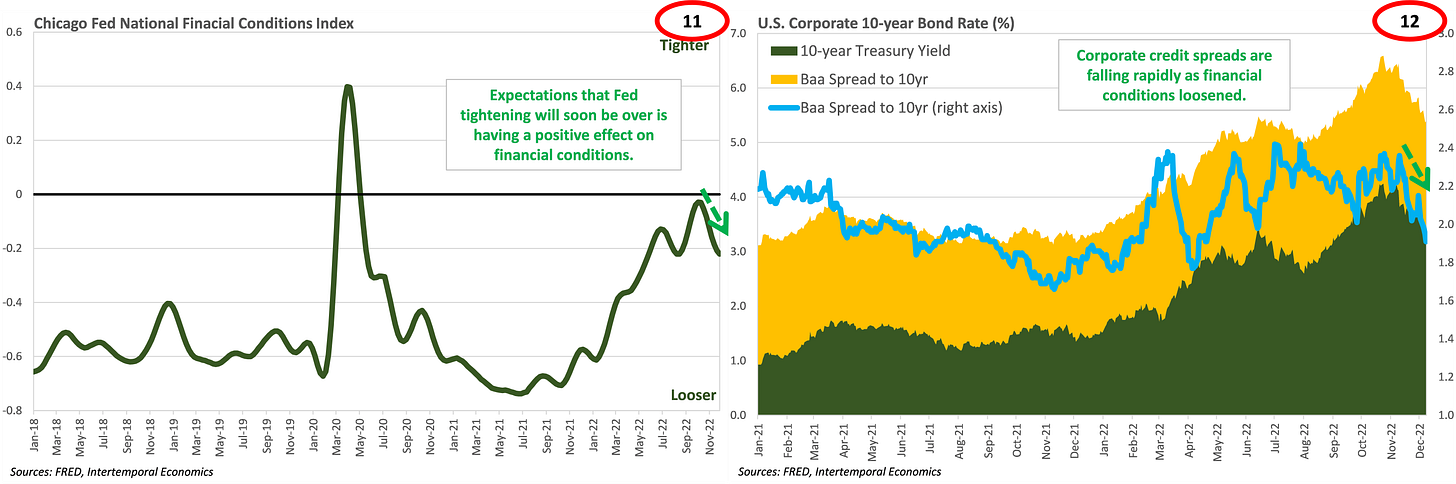

· Risk markets are signaling an expectation that the rate hiking cycle is over after tomorrow’s meeting with financial conditions easing and corporate credit spreads tightening rapidly (Charts 11 & 12). The Fed and the market are getting ready to declare victory over inflation and the achievement of a soft landing. Unfortunately, in an environment where many supply curves are steep any temporary reduction in the rate of price growth is just a Trojan horse for another burst of inflation once the central bank eases policy.

· This writer expects the FOMC to deliver on the expected 50bps hike expected by the market. More importantly, look for Powell emphasizing a “higher for longer” policy to make sure inflationary pressure has receded. The Chairmen himself will admit such talk is not a promise so the goal of statements of this kind is simply the forward guidance applied to talking the curve down during the days of QE.

· As was the case in 2011-2012, talking will not be enough to get the yield curve to stay the shape they want it so intervention will be necessary. The effort to shape the yield curve will begin with an operation “Untwist”, then asset sales, and eventually wind up at yield curve control.

Canadian Bond Markets

· The yield curve in Canada is experiencing the rapidly worsening inversion that is feared by policymakers in the United States. The long end of the yield curve in Canada fell over the course of November. Then last week’s rate increase of 50bps had zero effect on anything but the overnight rate (Chart 13).

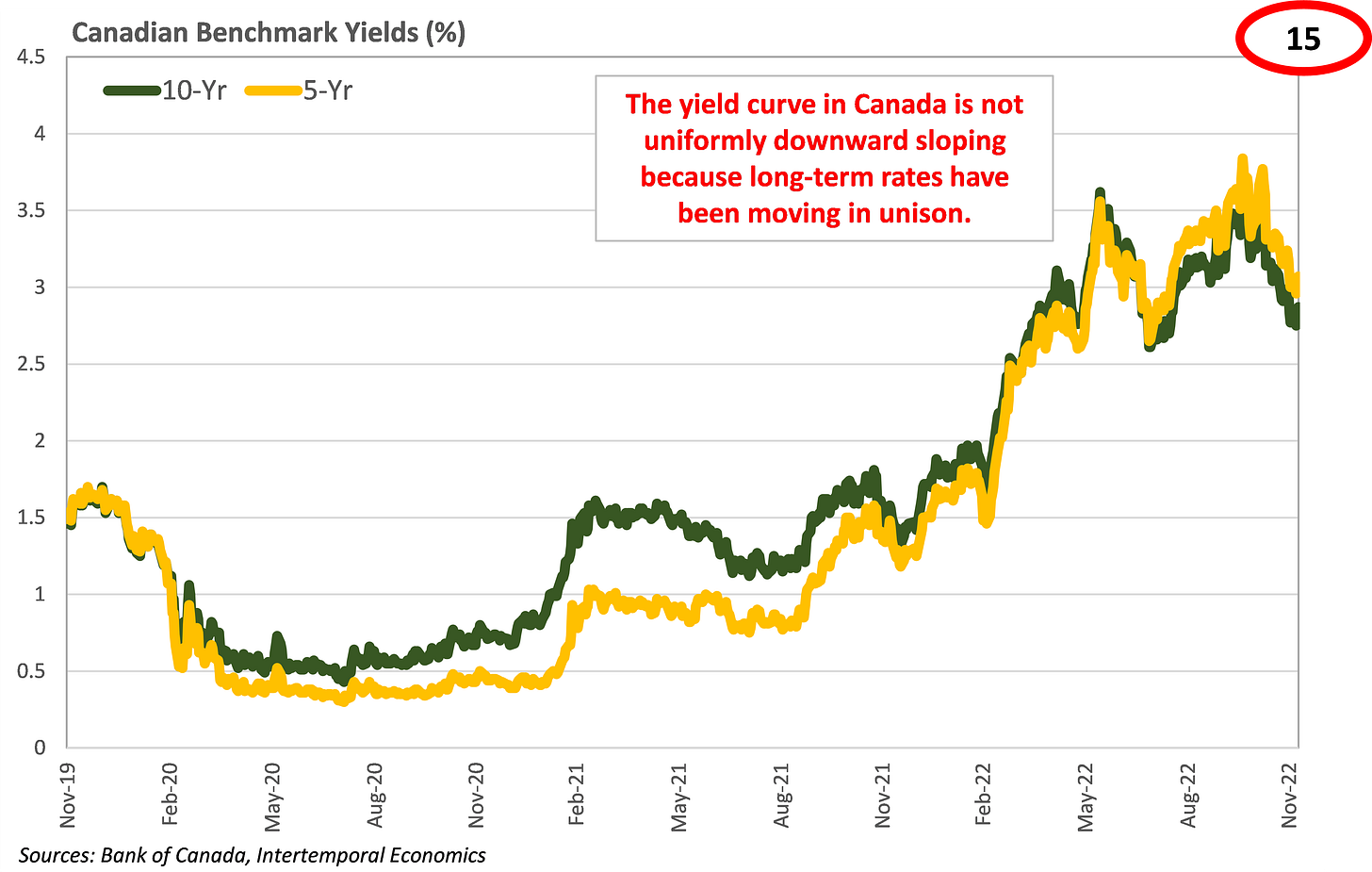

· Money market rates have continued moving higher but haven’t been able to keep up with the policy rate. Worse yet for the BoC, long-term bond yields are falling rapidly (Charts 14 & 15).

· As is the case in the United States, the back end of the yield curve in Canada is moving in unison. This writer thinks bond markets in both countries expect a market intervention that will reshape the back end of the curve.

· Bank of Canada Governor Tiff Macklem gave a speech on Dec 12th where he focused on talking up the yield curve and referenced New Year’s resolutions to make his point. The speech sounds like a mea culpa in advance for coming inflation. Key statements from the speech [emphasis mine]:

“At last week’s decision to raise the policy rate by 50 basis points we indicated that, looking ahead, we will be considering whether there is a need to increase the policy rate further. This means that decisions to raise the rate or to pause and assess the impact of past rate increases will depend on incoming data and our judgments about the outlook for inflation.”

“We are watching very closely to see how the economy is responding to higher interest rates. We are looking at an expanded range of labour market indicators to assess the balance in the job market and the impacts on workers.”

“In the future, it seems likely that supply chains will be shorter, more diversified and more resilient. Trade will likely narrow to more trusted partners. These changes will increase resilience but at the cost of efficiency. And through this adjustment, production costs could rise, increasing price pressures.”

“Over the long term, it seems likely that we won’t have the same disinflationary forces that we’ve had for the past 30 years. These potential developments could make it harder to bring inflation back to the 2% target and keep it there. But how much harder is very difficult to say.”

In the News

Half a million Syrians return from Turkey, but were they forced?

Erdogan calls on Putin to establish Syrian corridor

Erdogan says Turkey's strikes in Syria, Iraq may lead to ground offensive

An assassination, a feud and the fight for power in Iraq's Kurdistan

Iran strikes Iraqi Kurdistan again, warns of possible ground operation