U.S. Bond Markets

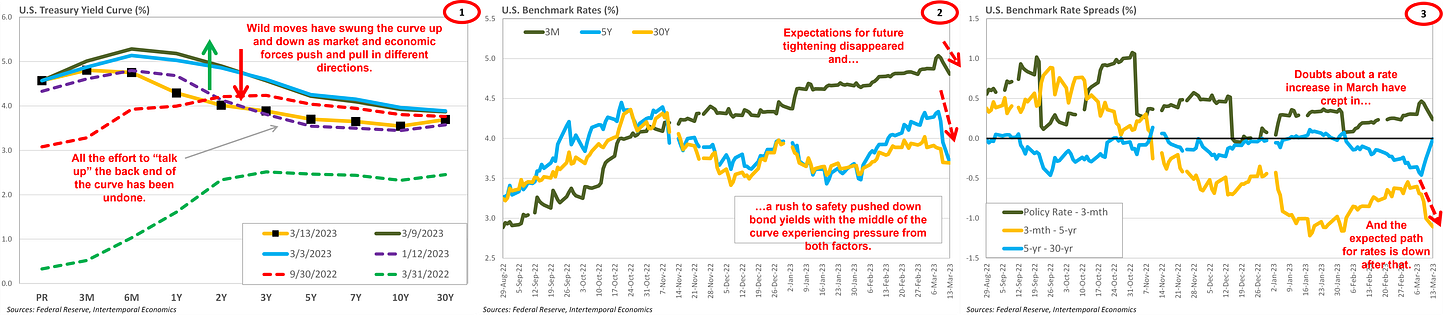

· Fear and confusion have rocked bond markets, and the banking sector writ large, since Friday’s sudden collapse of Silicon Valley Bank while the wider stock market has largely stood by in shock. The intense financial action juxtaposed with the sanguine economic situation highlights the artificial nature of the mini crisis.

· The blowup of Treasury-heavy banks in the U.S. is simply another incarnation of the LDI blowups observed in the UK in the long-long ago of six months past. Rapid tightening by the central bank exposed shoddy work done by financial engineers as structures came under more stress than anticipated. Leveraged financial structures will continue to exist as extreme financial fire hazards until the current age of inflation volatility has passed.

· As discussed in a past Weekly Beat, the BIS published an excellent piece discussing how “front loaded” policy tightening tends to be unwound shortly after rates peak because things tend to break. Everything is lining up for a dovish pause by the Fed in one or two meetings.

· Market participants have reacted to the recent banking turmoil primarily via the inflation expectations component of nominal rates. Unless a deflationary banking crisis occurs, the outcome of the current policy action is likely to be lower growth and higher inflation, rather than lower growth and lower inflation. More on this below.

G-7 Bond Markets

· Across advanced markets, with the notable exception of Japan, the middle of the yield curve sagged as a mix of fight to safety and rate cut expectations drove down short- and medium-term yields without any policy action taking place.

· Interestingly, this steepened the back end of many yield curves as long-term bonds were not as attractive from a safety standpoint and are not heavily affected by small changes to the path of policy rates. If rate cut expectations begin to gather strength, watch for the 3-month to 5-year curve begin to steepen. Unless an actual banking crisis occurs, a continued steepening in the belly of the curve is likely months away.

· If the financial engineering mini crisis in the U.S. gathers pace to become a global crypto-crisis then the job of central banks becomes much easier in the short-term. A generalized deflation in the value of non-productive “assets” would be an excellent way to depress demand without impacting productive investment.

· However, a successful intervention in the U.S will only serve to fuel inflationary fires globally as risk-taking in crypto and other non-productive areas will reaccelerate. That will put the world’s central banks in a very difficult position because they now know they stand on a brittle financial system which cannot easily weather another inflationary wave and subsequent further tightening.

· Despite numerous economic and demographic challenges, Japan is currently the only advanced bond market with a yield curve that looks at all normal. That is not accidental since the BoJ’s policy explicitly seeks to shape the yield curve. Diligent readers will know that I have been writing since September 2021 that other central banks will steadily move towards yield curve control. The UK and US have now both had near financial meltdowns because the yield curve behaved inconveniently for the central bank. How much longer can that last?

Economic and Financial Outlook

· Inflationary pressure has eased in the U.S. since peaking in late 2021 but has never really gone away. Commodity prices eased as the dollar rose, but the labor market continued to grind tighter and tighter. The potential for another wave of inflation is as strong as ever and needs only a push to get rolling downhill again.

· The big question now is how reactionary macroprudential policy becomes as a result of the recent bank failures. If the price of entry for the new term facility becomes no crypto or enhanced KYC then banks will likely pull back on the credit provided to the speculative boom driving so much consumer demand.

· The big swing factor right now is whether the shadow banking system that has grown up around crypto is brought under the umbrella of public money and stablecoins become real money instead of (money?). If such an expansion of the money supply occurs without the deflationary impulse of a physical investment bust (i.e. building fewer new houses) then conditions will become unequivocally inflationary. New money will have been christened to ex post legitimize the purchase of Bored Ape NFTs and other useless garbage.

In the News:

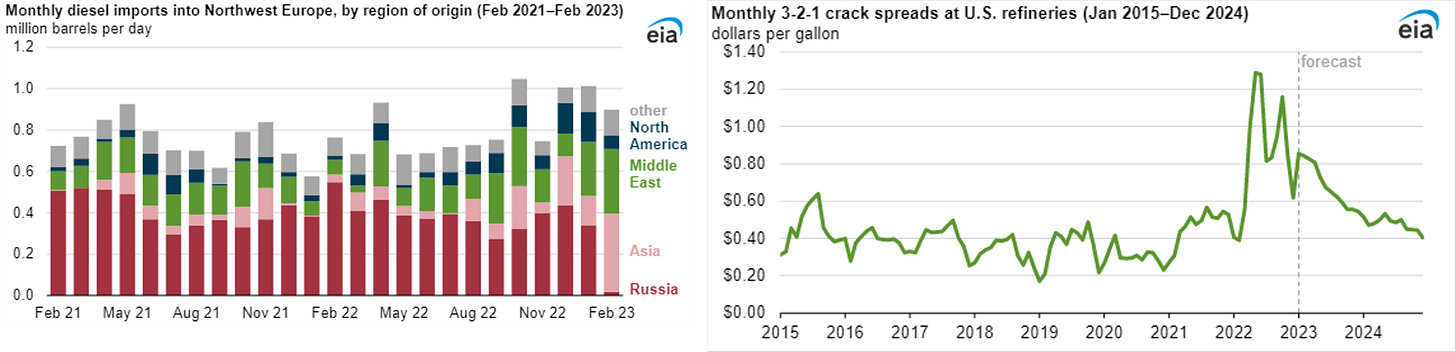

Bans on imports of seaborne diesel fuel from Russia into the EU became effective February 5, 2023. Although a large amount of Russian oil continues to be transferred between tankers just a few miles off the coast of Spain, petroleum product imports from Russia have declined. They have been compensated for by imports from other areas, notably the Middle East and Asia. The largest increase in diesel imports volumes to Northwest Europe came from Saudi Arabia

The need to bring resources from Russia to third countries before re-exporting to Europe means Russia’s “shadow fleet” of tankers and the remaining legal fleet of tankers must all be allowed to operate unfettered. If “the West” actually begins squeezing Russia or China with sanctions, there will need for stricter enforcement on the high seas. That seriously raises the risk that either of those countries will begin to disrupt Western commerce within their own spheres of influence – a topic of extreme importance for Indonesia and Japan.

Our Take: Hydrocarbon assets in the Middle East and India are currently cashing in on geopolitical tensions without consequence. In the near term, with global capacity already stressed, that is likely to remain profitable. However, as tensions rise it will become harder and harder for countries that control hydrocarbon assets OR TRANSPORTATION CORRIDORS to remain on the sidelines. Crack spreads are expected to taper off as the world acclimates to new sanctions regimes, but that view is likely too sanguine. Watch for opportunities to cash in on crack spread blowouts in 2023 and 2024 rather than a steady compression.

Appreciate your writings and the food for thought you have posed in this week's post.

Will the US and UK CBs start practicing yield curve control? I never actively considered this possibility.

And your observations on the hydrocarbon corridors in the high seas...very interesting and deserves some pondering re: it's implications to India's economy in particular.

Cheers!