U.S. Bond Markets

· Last week, the back end of the yield curve gave up all the gains made the week before. The result being that the yield curve is inverted from the 1-year maturity onward (Chart 1). The Fed’s room to maneuver is rapidly shrinking and bond markets are clearly concerned as the MOVE index is at levels not seen since the Great Financial Crisis (Chart 2). There is clearly extreme uncertainty as to which direction rates are headed.

· Market convention dictates use of the 2-10 spread as an “indicator” of recession but this rule of thumb is misconceived. During the post-WW2 era recessions have been exclusively triggered by yield curves inverted from the policy rate out to the long-term bonds. Partial inversions of the curve are not enough, likely because the financial system is adept enough at maturity transformation to avoid funding traps in the yield curve.

· Currently there is a small buffer of fifty basis points between the fed funds rate and three-month T-bills and beyond that the curve is flat to slightly inverted (Charts 3 & 4). As discussed in a recent note, the Fed is walking on the knife edge between runaway inflation and a bad recession. Eventually that game will end, but it will keep going as long as credit flows to the non-financial sector.

· The sudden decline in rates at the middle of the curve, as represented by the 5-year rate, is problematic because it puts consumer credit at risk of drying up (Chart 5). The back end of the curve remains a petrified stick that wags rather than a string that transmits economic vibrations. As a result, the 30-year rate moved down by roughly the same amount as the 5-year (Chart 6).

· Real rates moved down last week, even as the Fed threatened tighter policy (Charts 7 & 8). The case for a top in real yields, at least for the time being, is growing stronger. Either the Fed will slow rate increases and inflation will keep up, or rate increases will continue but tip the economy into recession and put the Fed into easing mode. Only Yield Curve Control will enable the Fed to bring long-term real yields higher without inverting the yield curve and pushing the economy into recession.

Financial Conditions

· As mentioned above, as long as credit continues to flow to the nonfinancial sector it is hard to see a recession occurring. Financial conditions have tightened considerably since 2021, as the Fed has intended, but they are not yet tight (Chart 9). Case in point are investment grade corporate bond spreads which remain subdued despite clear signs of upward pressure (Chart 10).

· Except for investment grade debt, capital markets have effectively been closed to issuers since December 2021 (Charts 11 & 12). This raises the possibility of a recession driven by a lack of credit creation. However, bank credit issued to households and businesses continues to grow rapidly (Charts 13 & 14).

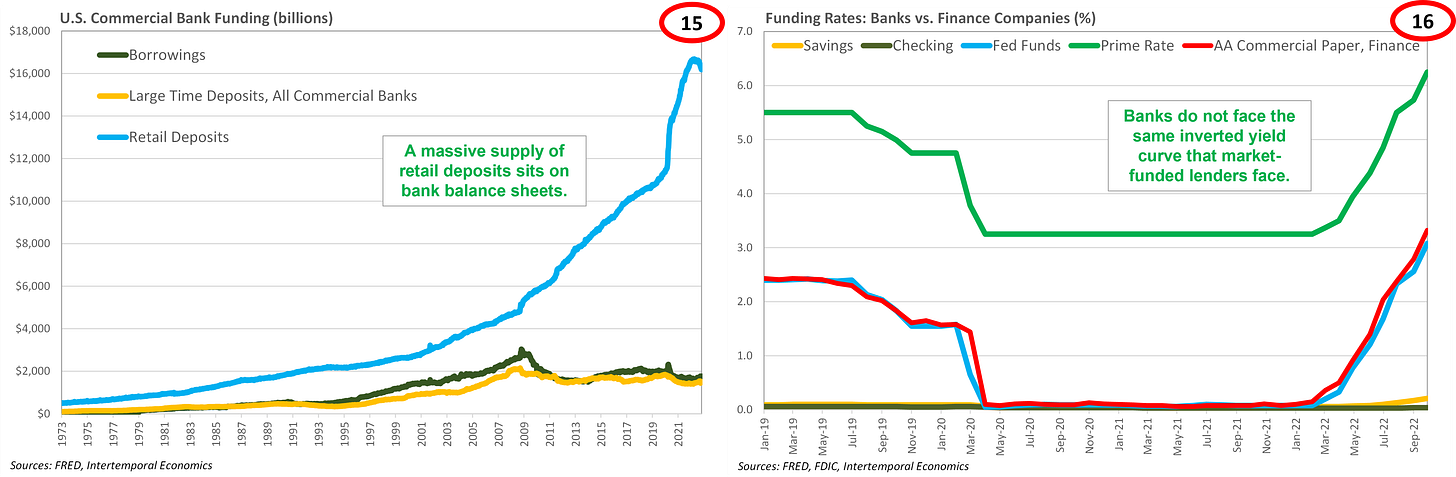

· Banks benefited from a massive buildup of deposits by the household sector and subsequently moved away from market-based funding for their balance sheets (Chart 15). Since 2021, interest rates on personal savings have risen to 21 basis points and rates on checking accounts remain glued to zero.

· Unlike market-based funded lenders, commercial banks are benefiting from a steep yield curve that is getting steeper (Chart 16). Bank profits will drive an increase in market funding available at favorable rates, encouraging further expansion of bank credit. It will be hard for the Fed to push the economy into recession with bank credit expanding so rapidly.

In the News

Ukraine Launches Unprecedented Drone Attack on Russian Black Sea Fleet’s Sevastopol Headquarters

Iran‘s Combat Drones in Ukraine War, a New Market

Ex-intel chief Talabany warns Iraqi Kurds risk civil conflict leaving Turkey, Iran room to meddle

If you enjoyed this post, please consider liking, commenting or subscribing as it helps immensely.

“It will be hard for the Fed to push the economy into recession...” loved reading this POV and your data and thesis backing this sounds pretty solid. Thanks for a great post.