I’m opening up the full Weekly Beat and comments sections to free subscribers this week. Please take a moment to like, comment and share with others - it helps immensely. This is a reader-supported publication and subscriptions are the best form of support. If you are able to make the small monthly payment, it means a lot financially and personally.

· The front of the yield curve continued climbing and flattening spread further down the curve over the past week (Chart 1). With the back end of the yield curve already flirting with inversion, a movement into deep inversion at the front end of the curve would surely trigger a recession (Chart 2). Until the full yield curve inverts, expectations for a recession are likely to be disappointed (Chart 3).

· The bond market is pricing in at least 75 basis points of tightening at the front end of the curve at the next meeting. If that occurs, the curve will only have 50 basis points of tightening space left before a full inversion occurs (Chart 4).

· Of course, if the 5-year rate moves higher inversion at the front of the curve could be forestalled (Chart 5). The 30-year rate would need to move higher as it has been a cap on the 5-year (Chart 6). We expect the FOMC to transition to yield curve control once the committee realizes it must guarantee an upward slope to the yield curve to prevent recession, while shifting the entire curve higher to prevent inflation. The FOMC has a delicate game to play until potential output increases to match actual output.

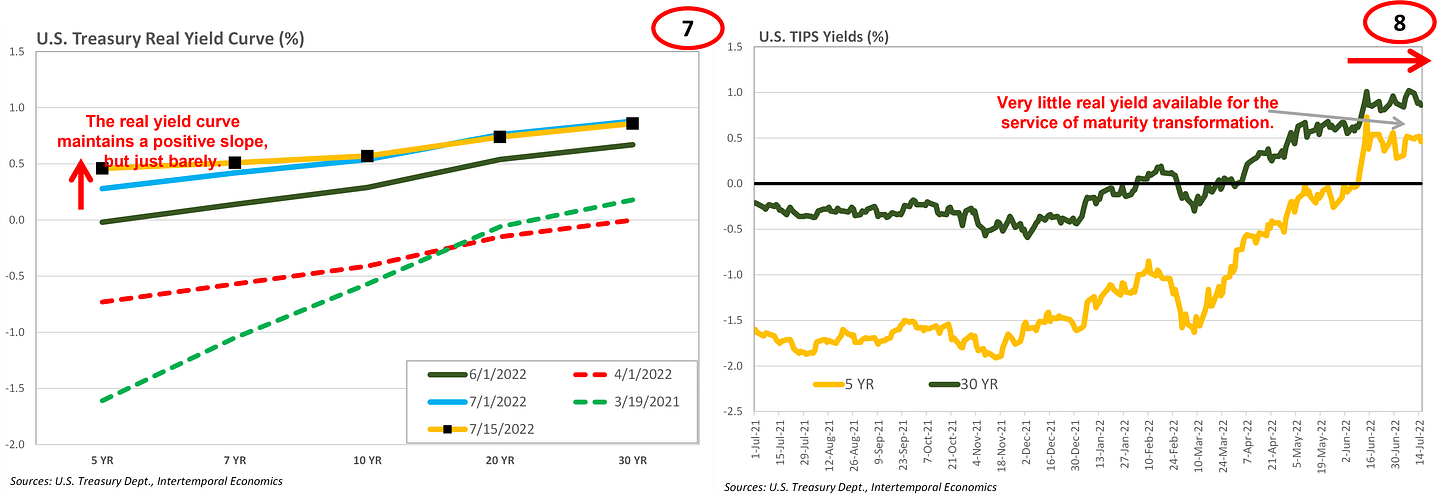

· A key indicator to watch for signs of deceleration pressure is the shape of the real yield curve, which currently prices in a nearly fifty basis point spread between the five-year and thirty-year bonds, despite nominal rates being flat across those maturities (Charts 7 & 8). That positive real yield spread is keeping investment from collapsing.

· Given that inflation expectations have deteriorated as real rates have increased, the Fed has been pushing on a string when it comes to nominal rates (Charts 9 & 10). That means shifting the yield curve with market operations likely will not be sufficient to maintain a positive spread in the curve and the standing repo facilities will need to be used to guide rates higher along the length of the curve.

· Financial conditions continued tightening last week along with the flattening of the front end of the curve (Chart 11). Note that spreads on investment grade corporate credit remain relatively tight (Chart 12). Credit market continue to function and our Stocks to Watch continues to favor the ‘haves’ of the credit world and firms with high rates of internal cash flow creation.

· Stocks to Watch: AMCR, ASO, AZO, CPB, K, PBFX, PM, PRTS, T, UL

Commodities

· The sudden and broad pullback in commodity prices has policymakers and market commentators breathing a sigh of relief, but we expect their relief to turn to exasperation before the year is out. Indeed, the pullback copper prices has raised questions among astute observers about the Fed having gone too far in its tightening campaign.

· We expect the slowdown in commercial lending to eventually force the Fed’s hand as firms go from understocked to overstocked as investment plans based on credit availability are put on hold. The Phillips Curve is steep because the economy is out of spare resources, including people. Prices might cool off fast once tightening occurs, but inflation will be back strong as soon as growth accelerates.

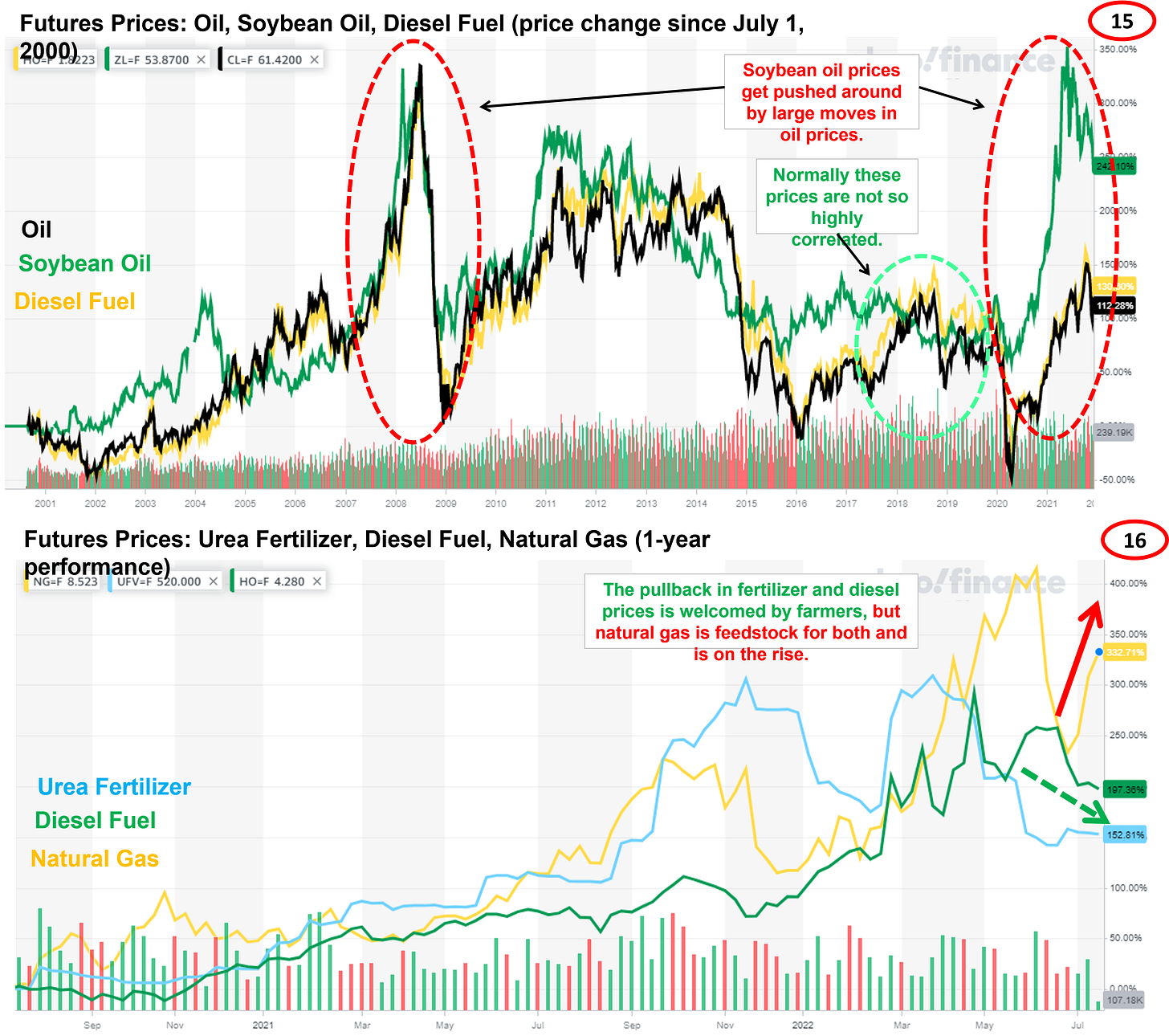

· The Fed has to be careful because the feedback loop between food and energy prices remains a threat while oil prices are above $80. Most importantly, regardless of the level, at times when the prices of oil moves by large amounts it takes vegetable oil prices with it. The link between oil and corn is already well established, but the link between vegetable oil and petroleum is likely to get stronger as renewable diesel gains in popularity.

· Furthermore, the link between hydrocarbon prices and food also exists in the feedstock use of natural gas for fertilizers and refineries. Oil prices might be pulling back, but natural gas prices are not, and these will feed through to food prices, which will eventually put additional upward pressure on oil prices.

· One factor likely keeping a lid on commodity prices recently has been the soaring value of the dollar against other advanced economy currencies, which is now spreading to emerging markets. That dollar “strength” is likely the sign of dollar shortages in offshore dollar markets, reflecting liquidity disappearing as the Fed implements tightening.

· Tighter financial conditions are clearly hurting emerging markets and the decline in commodity prices has provided to relief. Thus, the Fed could face external pressure to ease off on its tightening campaign because foreign economies are falling off a cliff, reducing inflationary pressure in the U.S.

· Oil prices have been making headlines, but it is worthwhile keeping in mind that in real terms the price of oil is at about the same level as 2018 and well below its pre-2014 price. Nominal rates reflect this lower real price.

Equity Markets

· The S&P 500 appears to be experiencing its third rally of the bear market that has defined 2022. The rally could get back to the long-term trend line this week and next but will likely run out of steam soon after. We expect another downward leg to accompany whatever news forces analysts to downgrade profit expectations yet again.

· Defensive sectors continue to outperform with consumer discretionary performing the worst among the S&P’s eleven sectors. The underperformance of the communications sector has stabilized, and some value opportunities are starting to show up in the sector. We are beginning to cautiously look at names in this sector.

· Given that access to capital is currently a dividing factor among companies, we do not expect to see an end to the S&P’s downtrend until the Russell 2000 (RTY) begins to outperform. Once the RTY crosses over the S&P 500 we will begin looking in earnest for value names that are oversold.

Stocks to Watch

· Stocks to Watch continues to be dominated by household brands as consumers defend their consumption baskets by borrowing and demanding raises. These firms have low betas to the larger market, which is vulnerable to financial shocks unrelated to the operating health of the underlying names. Firms with cheap free cash flow, strong dividends with a good coverage ratio, and low betas to the wider market are where we are putting money to work in current market conditions.