· Chairman Powell’s declaration on Friday that “with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause” sent equity markets into a spin. The speech did not carry the same shock value in bond markets, where the yield curve merely shifted up slightly (Chart 1).

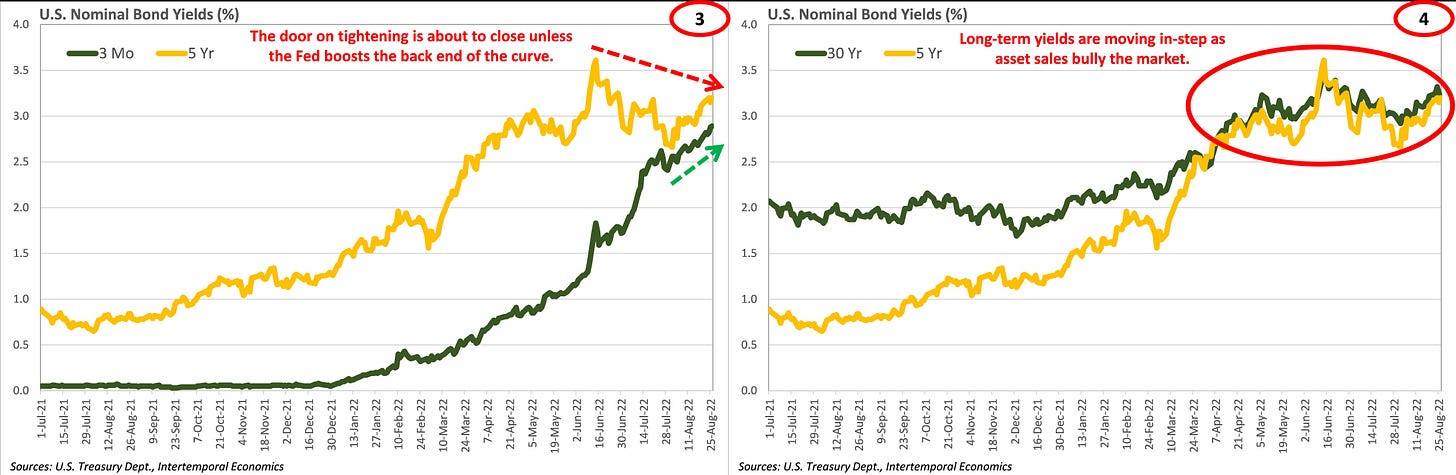

· Bond markets are much more sanguine about the Chairman’s statements, as evidenced by action at the front of the yield curve (Chart 2). Market expectations for tightening in the next three months are currently about a half percentage point. However, unless the five-year yield keeps moving up, the Fed will soon run out of room to tighten without inverting the yield curve (Chart 3). The back end of the yield curve has become a solid block glued together by the Fed’s pre-programmed asset sales (Chart 4).

· The Fed’s open market trading desk is most likely managing asset sales to prevent the back half of the yield curve from inverting. If Powell is serious about getting the Fed funds rate to four percent, he’s going to need to clear some “headroom” via yield curve control policy.

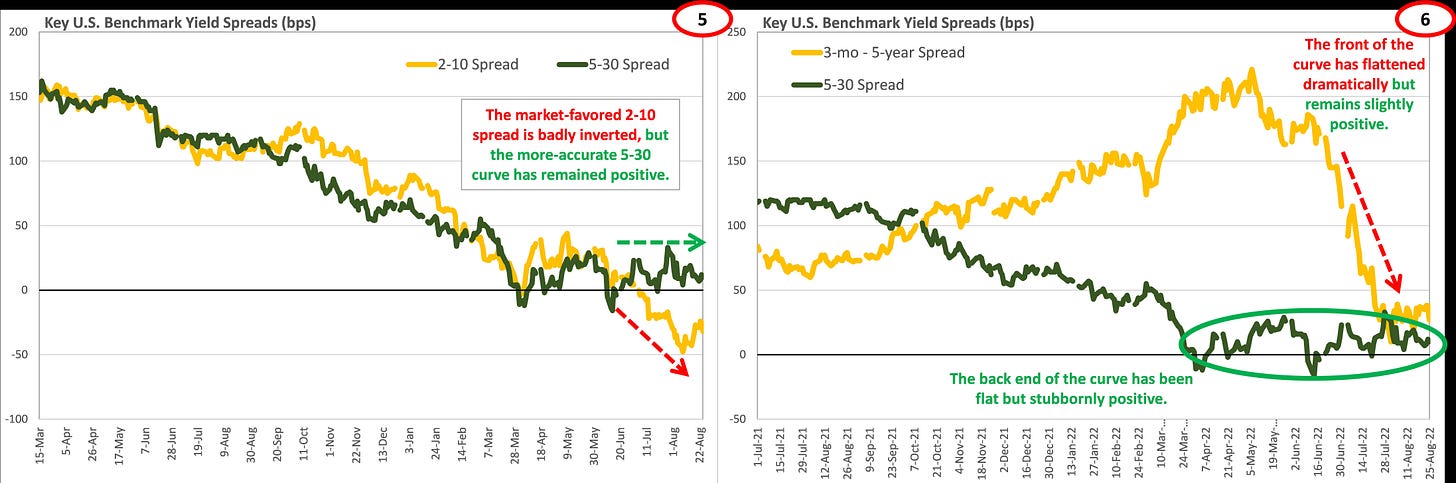

· The managed shape of the yield curve has resulted in strange and arguably erroneous “signals” being sent to capital markets. The most obvious of these is the inversion of the spread between two-year and ten-year Treasury bonds, the 2-10 spread (Chart 5). An inversion this deep is usually a loud and clear sign that a recession is incoming, but the 2-10 spread straddles the divide at around 2-3 years where the yield curve is “broken”.

· The front portion of the curve is dominated by forward guidance about the overnight lending rate, while the back portion of the curve is dominated by expectations for balance sheet policy. This contradiction in policy is distorting the yield curve and will need to be resolved at some point, but that will likely occur via policy-induced steepening and a resulting increase in bank lending. The fact that the yield curve overall remains upward sloping leads this writer to suspect recession calls are too early at this point (Chart 6).

Inflation Watch

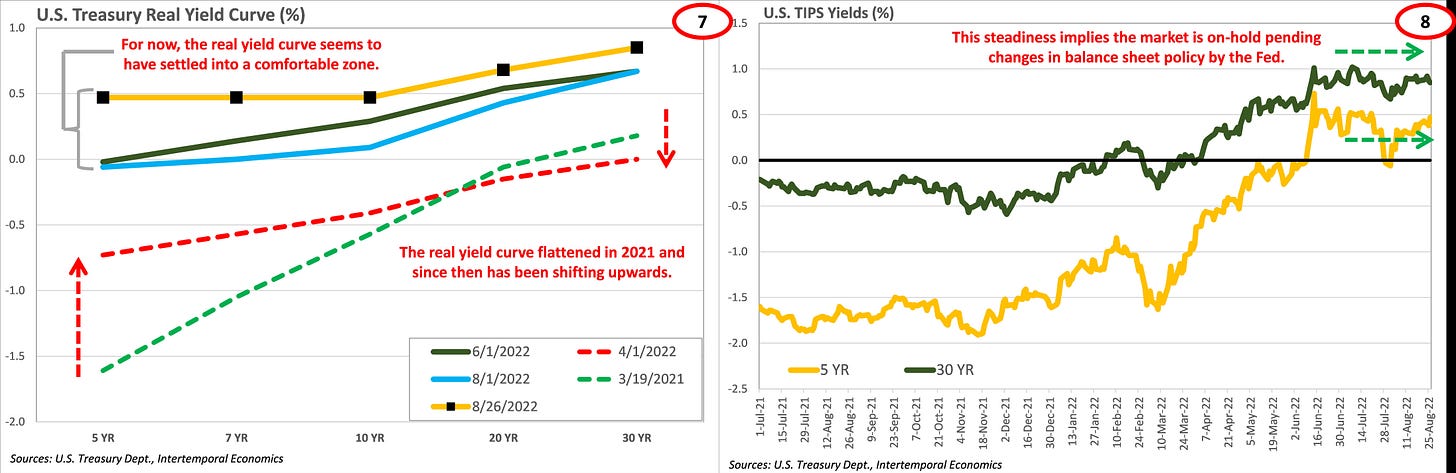

· Real rates have settled into a comfortable range over the course of the summer, as inflation started to settle down. For now, neither the FOMC nor its many mouths have been able to move real rates from where they settled in at the start of this summer (Charts 7 & 8).

· The stability of real rates, and the fact that the real yield curve has remained upward sloping, provide a useful opportunity to test the underlying strength of the U.S. economy (Charts 9 & 10). If the economy can sustain the current activity for several months under the pressure of positive real interest rates there exists at leas the possibility of a “soft landing”. I do not expect that outcome however, because internal inflationary momentum and external inflationary pressures will likely result in the Fed overshooting “neutral” and causing a recession.

· The ability of the U.S. economy to sustain oil price shocks without spiraling into runaway inflation or recession should be noted by economists. The real price of oil recently peaked right at the same level it did during the supply chain squeeze of 2018 and, notably, bond markets reacted in exactly the same way (Chart 11). The stability provided by a flexible oil supply is of supreme economic importance, just ask the Saudis.

· That being said, without either a dramatic improvement to worker productivity, an increase in labor market participation, or a deep recession, any acceleration to above-trend growth in the next few years is likely to rapidly generate unacceptable levels of inflation. The gold market has held up remarkably under the pressure of rising real rates and a strong dollar (Chart 12). If confidence in the Fed’s conviction to fight inflation wavers the feedback between rising inflation and lower real interest rates will send gold soaring.

· Obviously, the Fed is not going to be voluntarily reducing nominal rates anytime soon so for the gold market to get the lower real rates needed to push prices higher it will need to come via higher inflation. That might take several months or more.

· The Yardini Boom/Bust ratio has come down sharply recently as commodity prices eased off and initial claims for unemployment rebounded from unsustainably low levels (Charts 13 & 14). The inventory situation in the U.S. manufacturing sector is starting to recover and factory prices in China have reacted accordingly (Chart 15). That implies that for the next several months core inflation in the U.S. will continue to trend down (Chart 16).

· Supply chains are stabilizing, if not normalizing, and motor vehicle output has started to recover from depressed levels seen in 2021 (Charts 17 & 18). Of course, these indicators do not mean inflationary pressure has magically disappeared. With a steep Phillips curve, any time monetary and fiscal authorities ease-off the stimulus they will notice an immediate drop in inflationary pressure. However, the reverse is also true in that once they begin to worry about over-tightening they will be met with a burst of inflationary pressure.

Equity Markets

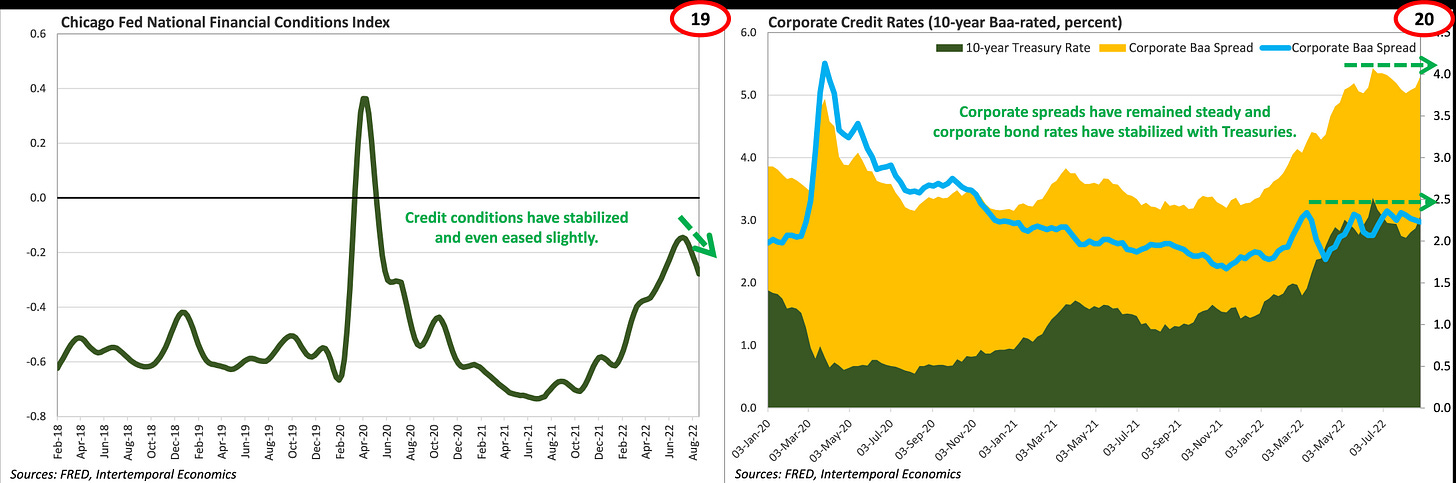

· Financial conditions are tighter than they were six months ago, but they are not yet “tight” and have in fact been trending looser in recent weeks (Chart 19). Indeed, while the Fed has done its part in raising the base rate, credit markets have kept spreads steady despite deteriorating economic conditions (Chart 20). Thus, while business conditions are more difficult and capital is scarce, the situation is not one of an unstoppable slide into crisis – yet.

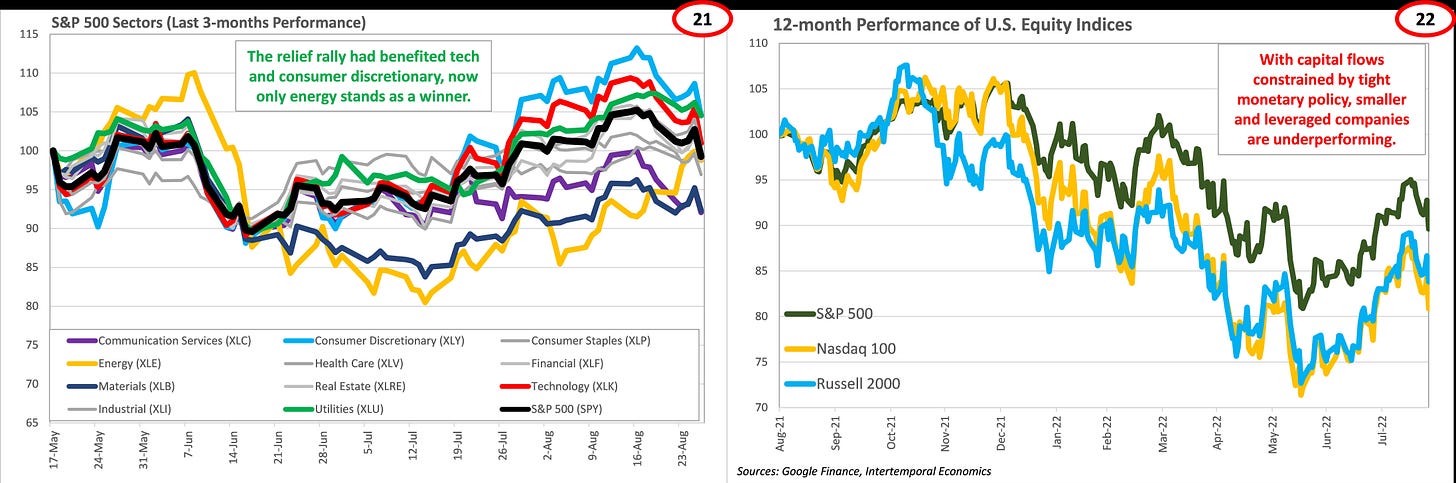

· The big losers of early in the Summer have been the big winners of the recent rally (Chart 21). Russia’s recent moves to further weaponize energy against Europe is likely to keep the bid going for energy stocks. Given the constraints on credit and risk-friendly capital, this writer expects movements upward in the S&P 500 to be bear rallies until the Nasdaq and Russell 2000 start to outperform (Chart 22).

· While the market remains in bear mode, watch for outperformance of the consumer discretionary sector (XLY) to serve as a warning that bear rallies are about to run out of steam (Charts 23 & 24). Indeed, this indicator was already flashing warnings prior to the current selloff.

· Immediately prior to the Jackson Hole conference the S&P 500 had clawed its way back to the long-term trend and looked ready to make gains if given some good news. Unfortunately for equity investors, that news was not forthcoming, and the next downward leg of the bear market kicked off. However, investors should be careful about taking Powell at his inflation-fighting word. The current Chairman is no Arthur Burns, conspiring with Nixon to manage monetary policy according to the political calendar, but it would be naïve to think he is not under pressure to give interest rate increases a rest.

· Investors should also be cautious about assuming the Fed’s ability to slow the economy down is what it used to be. As I wrote recently, the switch to an ample reserves regime post-Great Financial Crisis gives the Fed much less control over the funding costs of banks. Any pause in tightening is likely to kick off a round of bank lending as banks and borrowers take advantage of policy stability to execute plans.

Please like, comment, and subscribe if you enjoyed this note as each of those actions puts a little “gas” in the tank here at Intertemporal Economics. Just clicking like is immensely helpful and is an important source of emotional compensation for writing these notes.