· The minutes from the May 3-4 Federal Reserve meeting were released this week and, naturally, the most important statements got stuck in at the end. The key statements were: “At present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook.” and “Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.”

· Despite some of the “walking back” members of the FOMC have done in recent weeks by bringing up the potential for a “pause” in tightening, the statement makes clear the Committee feels the least risky course of action at this point is to get “ahead of the curve” to where they can make decisions with a lower level of political pressure being applied by all sides. To do that, the committee is willing to flirt with “restrictive” policy.

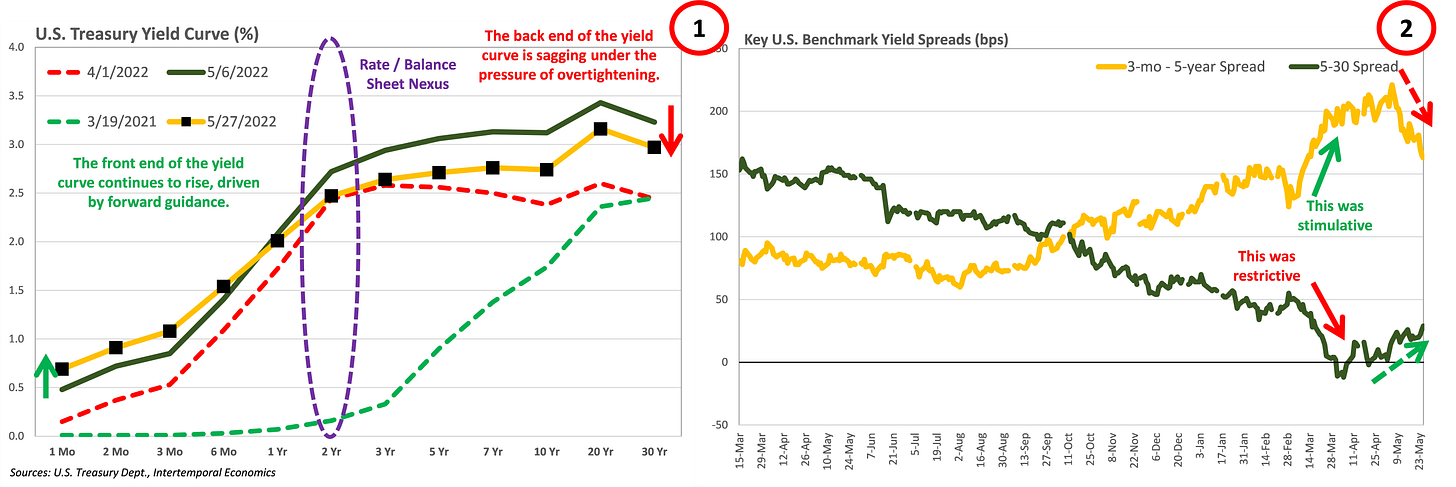

· The primary obstacle standing between the Fed and its goal of a “soft landing” is the broken state of the yield curve, which they themselves created. The front half of the yield curve is dominated by monetary policy expectations – now known as forward guidance because the Fed half-promises what the path of policy rates will be. The back half of the curve is a much harder beast to control because the market for Treasury bonds and derivatives is broad, deep, and largely unregulated. The Fed has been able to push the back half of the curve around with asset purchases and, increasingly, forward guidance about asset purchases. That last bit is critical because it is the American equivalent to Yield Curve Control.

· Reserve Board member Christopher Waller delivered a speech May 6th, just after the most recent meeting. In that speech Waller points to the two-year rate as his preferred measure of overall tightness along the yield curve. He doesn’t say why exactly, but I would editorialize because that is where the two halves of monetary policy meet up. That implies a real problem for the Fed if the two halves do not align. The economic pressure on the market to align the yield curve can be seen in the steady “pivoting” of the yield curve around the middle of the curve (Chart 1).

· The best evidence that two halves are not aligned can be seen in the divergence of the 3-month to 5-year Treasury spread from the 5-year to 30-year spread (Chart 2). This is a highly unusual market event and problematic for the Fed because arbitrage will tend to push the curves back into alignment.

· The movement of the 5-year that took place earlier in the year was highly stimulative to consumer lending because the portion of the curve where banks make money on consumers was steeper (Chart 3). In contrast, the movement of the five-year rate relative to the thirty-year was highly restrictive in the market for capital (Chart 4).

· The increase in rates has been entirely driven by the real portion of rates, rather than inflation expectations. The good news is that the movement in real rates implied investor confidence in long-term growth prospects of the U.S. economy (Chart 5). The bad news is that for the month of May real rates have been stuck and starting to look softer (Chart 6). If policy rates cannot climb further, then long-term rates will begin to experience downward arbitrage pressure. The current shape of the yield curve only makes sense if the Fed follows through with a “robust” tightening campaign. If that cannot be mustered, then something must keep the yield curve from collapsing. This writer proposes Yield Curve Control will be the solution.

· Real interest rates have moved up along the yield curve over the last three months, but the development in five-year nominal rates has been the worst-case scenario for the Fed (Charts 7 & 8). Real rates have been rising, but inflation expectations have been falling. With the net effect that nominal rates are being pulled down just as the Fed is trying to apply tightening without inverting the yield curve.

· That is of course the trick, to tighten financial conditions while allowing enough spread between maturities for banks and other leveraged lenders to continue making money by allocating capital. The market has made a clear ruling that the Fed missed its mark by excessively tightening conditions for businesses in capital markets, while loosening financial conditions for consumer lending (Charts 9-12).

· The stop-go-stop economic conditions that policy mismatch creates will be difficult for policymakers and investors to navigate, more on this below.

· Stocks to Watch: ABBV, T, CPB, CAG, CTVA, CPG, DDS, ET, EPD, EILD, IBM, ORAN, PBFX, PM, TMST, WMB

Inflation Volatility is the Future

· As discussed in my note “A Close Look at U.S. GDP” of 24 May 2022, I discussed my expectations for higher inflation and growth volatility (Charts 13 & 14). In short, pressure to keep consumer goods on shelves has come at the cost of components for capital goods going undelivered. Such a situation implies that, at some point, inflation will be “built-in” because the machines making consumer goods will be depreciating faster than they can be replaced. Indeed, light trucks are already becoming a valuable commodity that are increasingly unbuildable.

· In the near-term, a slowdown in demand from the business sector and a rush of deliveries from China after Shanghai reopens, could put further downward pressure on the price pressure relief that is already showing up in the system (Charts 15 & 16).

· The prices for gold and oil in relation to nominal and real interest rates provides interesting insight into whether the views of commodity and bond markets are aligned. Looking at the market for inflation expectation via the 10-year Treasury futures prices shows that if oil prices were to rise further it would put a lot of upward pressure on nominal rates (Chart 17). More likely though is a near-term slowdown that brings down rates and oil prices. The price of gold has been remarkably strong in the face of rapidly rising real rates (Chart 18). Gold investors are fading the rise in real interest rates.

· There are clear signs that the boom has peaked in the near-term at least, and the Fed might end up surprised by just how much inflation eases (Chart 19). If that occurs then there could be a “pause” in tightening, but with inflation momentum in the system the lack of tightening is equivalent to easing. With a potential growth rate below zero any pause in tightening would rapidly be met with accelerating inflation. As a result, the divergence between the currencies of advanced economies and emerging economies is likely to revert in short order (Chart 20).

· The economics community has fixated on wage-price spirals because that has become the straw man blamed for the inflation of the 1970s. Much more likely to fuel inflationary expectations will be the procyclical relationship that has developed between food and hydrocarbon prices. The relationship between corn and gasoline via ethanol is widely known. Less well-known is the relationship between the prices for edible “vegetable” oils and diesel prices via renewable diesel. When fuel prices rise there is automatic demand pressure on the food supply, increasing demand for diesel fuel and fertilizer to plant more fuel, which of course creates more demand for hydrocarbons. Round and round the inflationary cycle will go until the Fed ventures into “restrictive” territory and crashes the economy. See Charts 21-24)

· Perhaps worse of all, restrictions on food exports already cover a larger share of the global trade in calories than during the 2008 food price crisis. The illiquidity of the global market for food means that any restrictions on trade result in exaggerated moves in prices. The Arab Spring and resulting nightmares were the result of destabilization caused in 2008 and again in 2011 when food prices spiked along with oil prices (Chart 25).

Keep reading with a 7-day free trial

Subscribe to Capitalist Pig Collective to keep reading this post and get 7 days of free access to the full post archives.