U.S. Economy

· All eyes are on the Fed this week for signs that the Open Market Committee is losing its nerve for inflation fighting before the battle is done. There are clear signs that the economy is about to suffer a bout of supply chain whiplash that will flood inflation indicators with deflationary warnings signs over the next 2-3 months (Charts 1-3).

· Those deflationary warning signs will be plenty of reason to give the FOMC pause, particularly as the U.S. enters the 2024 Presidential election cycle. However, despite the likelihood of a rapid deceleration in inflation, severe inflationary pressures remain, and the second half of 2023 will likely be a period of accelerating inflation.

· Indeed, the seeds of the next inflation may have already been sewn in the China reopening. Chinese factory prices accelerated in December, sooner than would have been expected given conditions in the United States. There is good reason to expect the orgy of consumption and social disorder that followed COVID reopening elsewhere to be repeated in China.

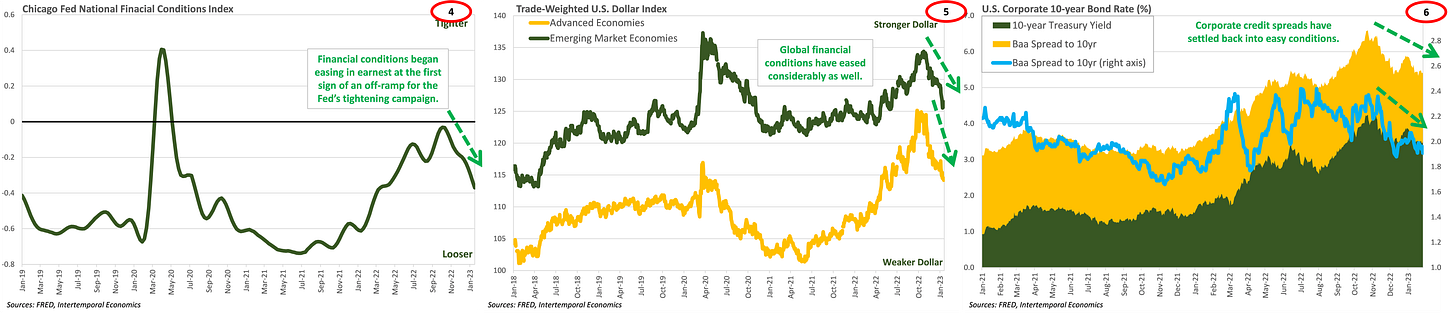

· Financial conditions began loosening as soon as inflation began easing back in November and the President celebrated that fact on his Twitter account. Dollar funding conditions have eased considerably in developed and emerging markets, while corporate bond markets in the U.S. have tightened. This writer will be watching the SIFMA data for signs that that IPO and junk debt issuance is returning for harbingers of inflationary growth. Charts 4-6.

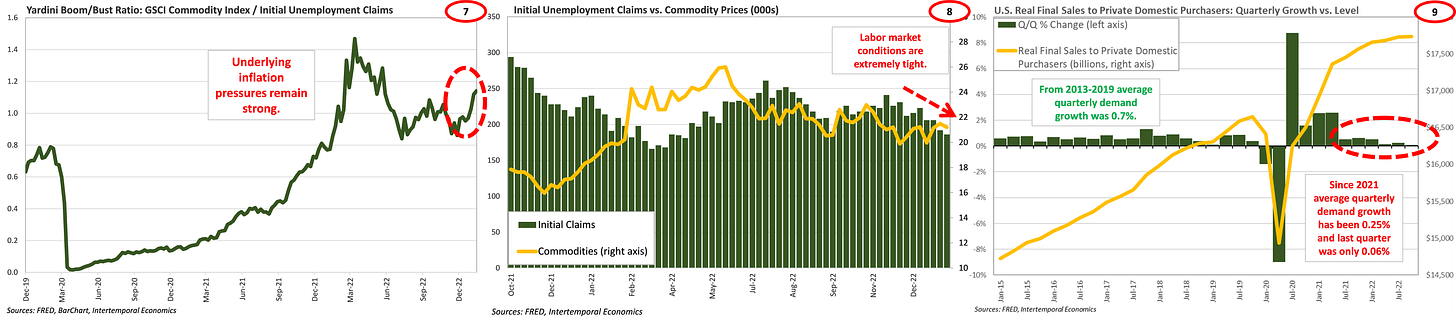

· Inflationary pressure remains acute, no matter what measures of inflation are currently reporting. The labor market remains extremely tight and a simple reduction in demand for labor will not be enough to loosen it. The labor market is “tighter than tight” in that demand can fall without inflationary pressure being brought down. Charts 7-9.

· Efforts to manufacture politically attractive rates of GDP growth and unemployment will lead to more ugly inflation as policymakers look to squeeze more output from an overextended economy. Whether it is inflation, consumer debt growth, or labor shortages, signs abound that the economy has run out of capacity to expand output and that maintaining existing output will be difficult without further inflation. The inventory whipsaw will send deflationary signals in 2023 that will fool nervous and politically minded policymakers into running headfirst into the next inflation sometime in the second half of 2023 or early 2024.

U.S. Bond Market

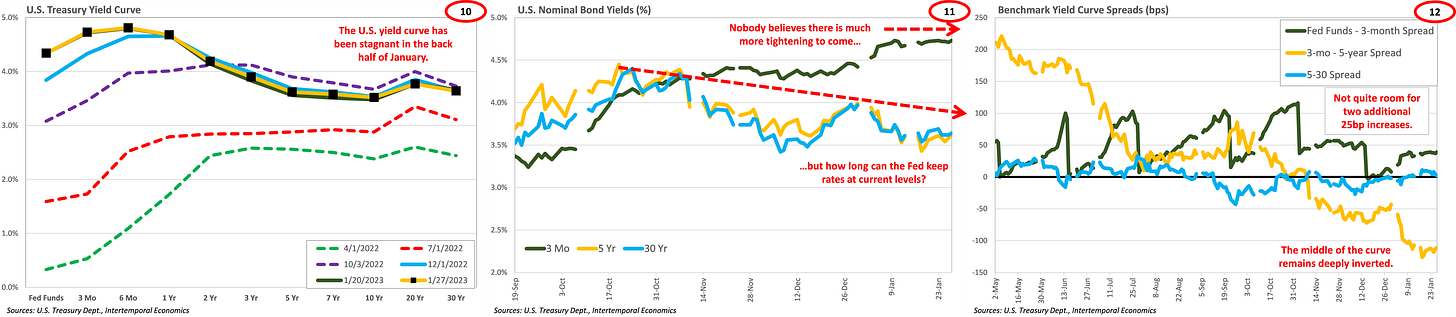

· The bond market appears undecided over whether the Fed will manage one or two additional rate increases of 25 basis points, but confidence appears high that a terminal rate of 5% cannot be achieved. Efforts to jawbone the market higher perhaps achieved some ground in the weeks after the meeting as the three-month rate moved higher in early January.

· However, while markets took the threat of higher rates seriously, the threat of balance sheet unwinding seemed to have faded somewhat. Long-term rates declined in opposition to higher short-term rates and the middle of the curve sagged deep into negative territory. That is not the bullish tightening the Fed was looking for where the curve steepens and rises. As I’ve discussed extensively in prior work, Yield Curve Control to steepen and raise the curve will eventually be the Fed’s only recourse.

· The seeds of inflationary pressure are visible in bond markets as real rates drift down, providing a persistent bid to gold and other real assets in the face of any deceleration in economic activity. Bond markets have become extremely sanguine about the threat of medium-term inflation and seem to see the issue as one of near-term pressure only.

· The Fed will be directly targeting the shape of the nominal yield curve with any YCC and such a policy will likely need to include provisions for stabilizing real yields via the TIPS market. That means idiosyncratic issues will be most likely to show up in breakeven inflation. Watch for trade opportunities in the remainder variable.

G-7 Bond Markets

· Only the policy rate responded to the Bank of Canada’s 50bps rate increase last week, indicating a firm conviction that the BoC is done tightening for this cycle. The three-month rate even lagged the rate increase, perhaps indicating some expectations that a policy error has occurred, and a reversal will be soon coming.

· The situation is very difficult for the Bank of Canada because long-term rates have sagged well below recent highs and the middle of the yield curve is badly inverted. Righting the yield curve with YCC policy is particularly dangerous in Canada where so many homeowners are exposed to the middle of the yield curve via adjustable-rate mortgages. That makes it difficult to support home prices by fixing the yield curve shape and encouraging credit creation simultaneously.

· The yield curve in the UK has taken on a ‘U’ shape as damage from October’s gilt smash-up appears to have become a feature of the market for the time being. Nobody really knows the full implications of underfunded pensions using derivatives because the authorities got it out of the news as quickly as possible. The problem came to a crisis most rapidly in the UK, but other developed markets with large pensions (the US and Netherlands) will likely face different manifestations of the same problem on the next tightening fire-drill.

· The Bank of Japan continues to suffer from the good problem of having an extremely steep yield curve and has struggled with market pressure in implementing its Yield Curve Control policies. However, despite market expectations that the BoJ will throw in the towel on YCC, this writer expects other central banks to eventually migrate towards a coordinated yield curve policy. Coordination will make life easier for BoJ as it fights the market with the combined powers of the world’s major central banks.

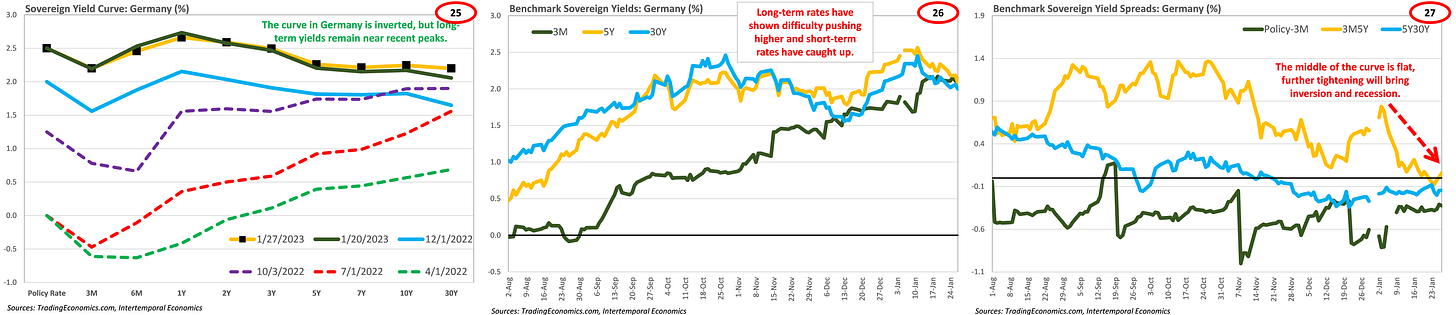

· The yield curve in Germany has flattened as the ECB has hiked rates, but long-term rates have not sagged by as much as they have in the U.S. and Canada. The result being that the middle of the yield curve has avoided, although just barely, the inversion plaguing the rest of the world. Look for the ECB to take advantage of some currency strength on the back of a Fed pause by slowing the currency union’s pace of rate increases.

In the News: Drone Wars Go Regional

Iranian Drone Exports to the Balkans and Its Geopolitical Repercussions

What Iran’s Drones in Ukraine Mean for the Future of War

Joint Azerbaijani-Turkish Military Exercises a Warning to Both Tehran and Moscow

Nagorno Karabakh: The Coming War on Russia’s Doorstep (VIDEO)