U.S. Bond Markets

· The yield curve continues to pivot, despite the Fed’s best efforts to prop up long-term yields by “jawboning” the market (Chart 1). The recent talk among FOMC members has been focused on “higher for longer” as the committee tries to use unofficial guidance to move rates.

· The political impetus for lower rates is dominating the policy impetus for higher rates (Chart 2). On November 10th the CPI report came in at a high absolute level, but month-over-month the rate was flat. Biden tweeted in celebration and markets took notice. Equities rallied, bond yields collapsed and have been trending down since.

· The political establishment has good reason to be worried about the Fed’s plans as there are only 60 basis points of cushion before the entire yield curve is fully inverted (Charts 3 & 4). Credit continues to flow for now but might not if the curve fully inverts.

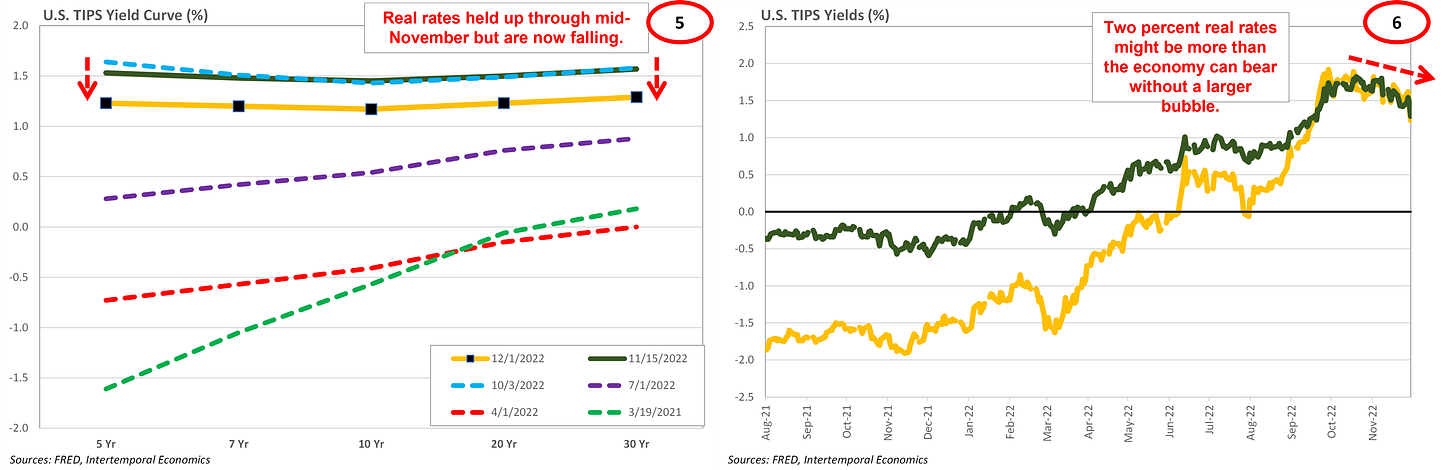

· Real rates have been coming down rather than inflation expectations (Charts 5-8). Falling real rates are dragging down nominal rates. Nobody except the Fed thinks they will be able to keep the policy rate high enough for long enough to matter for long-term yields.

· The interview Powell gave at the Brookings Institute gave plenty of insight into the Fed’s thinking about the dilemma the FOMC find themselves in. According to Powell [all emphasis mine], “the time for moderating the pace of rate increases may come as soon as the December meeting” but “the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation and the length of time it will be necessary to hold policy at a restrictive level”

· Powell emphasized the importance of long-term real interest rates in the committee’s thinking in saying “we'll look at, at the whole, the entire rate curve, if you think about risk free, the Treasury rate curve, we'll look to see positive, significantly positive real rates across the curve.”

· He also emphasized that the Fed will be running the economy almost at potential output and that eventually potential output will outgrow actual output. The Fed’s thinking on the matter can be summed up in the underwhelming statement that “We tend to assume things will go back to the way they were just naturally. But that doesn't seem to be happening so far.” Additional highlights can be found below.

· Financial conditions continue to ease, and corporate credit spreads remain constrained, albeit with increased volatility (Charts 9 & 10). Once the market decides the Fed is done tightening, whether the Fed says so or not, risk markets will go on a tear and economic activity will accelerate. Within a year of that, perhaps six months, the U.S. economy will be right back in the overheated state observed only a few months ago.

In the News

Kyrgyzstan and Tajikistan Descending Into Chaos and Full-Scale War

Tajikistan’s Gas Boom: Prosperity or Conflict?

China’s Secret Debt Deals With Tajikistan Are A Cause For Concern

PipeChina begins building pipeline to import gas from central Asia

Highlights From Powell’s Nov 30, 2022 Speech at Brookings

Key Quotes from: Inflation & the Labor Market [emphasis mine]

https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm

-- Slowing demand growth should allow supply to catch up with demand and restore the balance that will yield stable prices over time. Restoring that balance is likely to require a sustained period of below-trend growth.

-- It is far too early to declare goods inflation vanquished, but if current trends continue, goods prices should begin to exert downward pressure on overall inflation in coming months.

-- Core services other than housing, and this spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation

-- Monetary policy affects the economy and inflation with uncertain lags, and the full effects of a rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our price, our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability requires holding policy at a restrictive level for some time. History cautions strongly against ty will prematurely loosening policy.

-- We want wages to go up strongly. But they've got to go up at a level that is consistent with 2% inflation over time, making basic assumptions about productivity. And I would, so if you look at the principal wage measures that we look at, I would say that you're one and a half or 2% above that with, with current wage increases

-- We still have a 2% inflation and to keep inflation expectations anchored. But target, and we still have to use our tools to achieve it it's a, it's a very hard to know, it's very hard to know the answers to these things. I mean, we, we tend to assume things will go back to the way they were just naturally. But that doesn't seem to be happening so far.

-- We also look at the effect that the tighter financial conditions are having on the real economy, particularly now interest sensitive spending, but also, you know, other things as conditions tighten. We also look, so one of the financial conditions we look at, we'll, we'll look at, at the whole, the entire rate curve, if you think about risk free, the Treasury rate curve, we'll look to see positive, significantly positive real rates across the curve.

-- David Wessel [00:37:34] So an estimate of the neutral rate of interest didn't seem to be one of the big factors in that list you gave.

Jerome Powell [00:37:39] No it's So you look at the real rate curve, you'd in there, you, it's in there in looking at the real rate curve. You'd want, policy, real rates to be above what we'd estimate as the longer run neutral rate. The issue is, you know, the longer run neutral rate is, is a rate at a time of full employment and 2% inflation and the economy in perfect equilibrium. That isn't where we are

-- We have to do what it takes to restore balance in the labor market to get back to 2% inflation. And that's what we're doing, really, just by slowing growth, job growth, rather than putting people out of work.

I always enjoy reading your updates and your graphs are top notch!