Thank you to everyone who has taken the time to hit the like button, comment, or subscribed. If you enjoy this note, please take a moment to like, comment, and subscribe as each of those actions puts a little “gas” in the tank here at Intertemporal Economics. Just clicking like is immensely helpful and is an important source of emotional compensation for writing these notes.

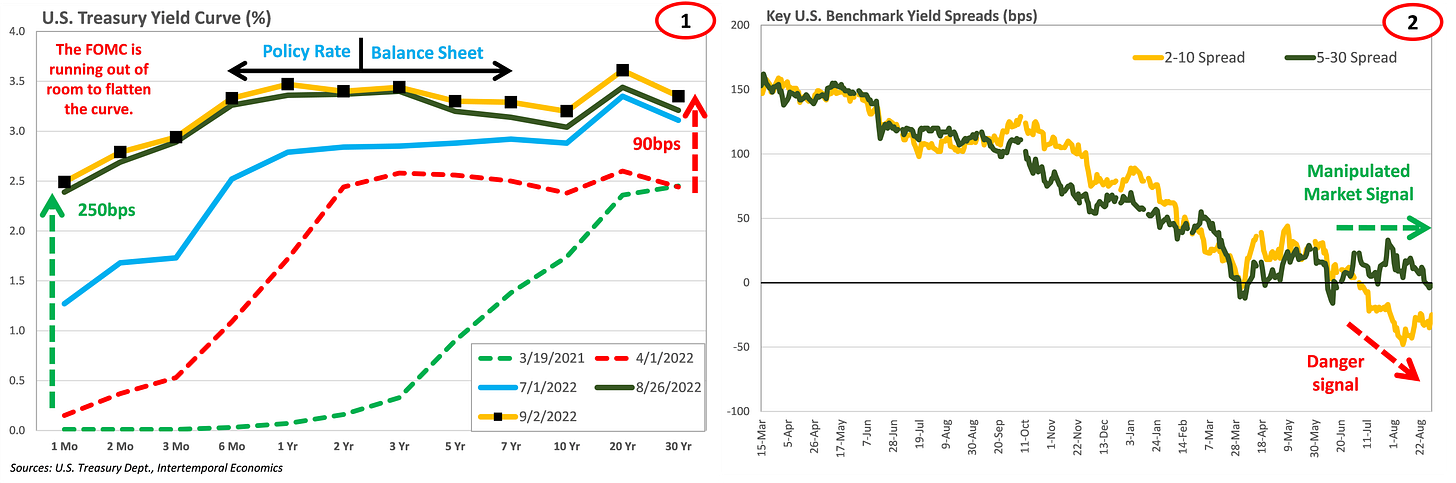

· A hawkish statement by Chairman Powell last week at Jackson Hole sent a shudder through equity and fixed income markets. It remains to be seen whether he can back up his rhetoric as the front end of the yield curve is catching up to the back end.

· Seemingly contradictory signals sent by different maturity spreads shows us the seam between maturities influenced by forward guidance and those influenced by balance sheet policy (Charts 1 & 2).

· The market took Powell at his word and began pricing in more aggressive tightening in the next few months, but there is very little spread beyond the 3-month maturity to continue tightening (Chart 3). The good news is that across the length of the curve the slope remains positive (Chart 4). The Fed will likely need to take action to keep the slope of the curve positive if it wants to keep raising the policy rate.

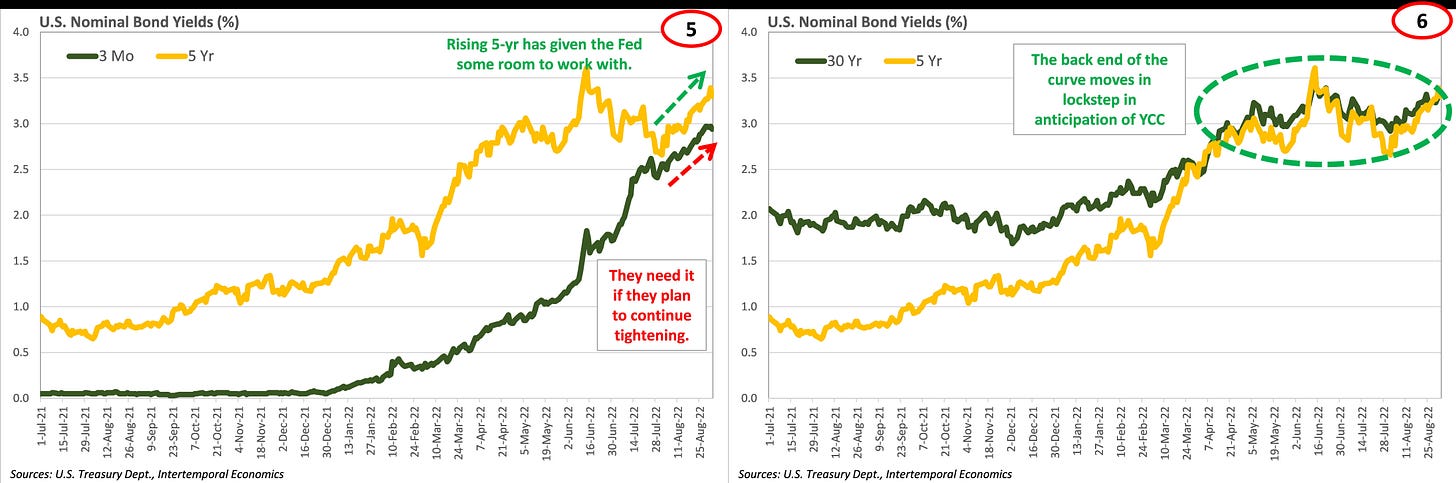

· The five-year Treasury rate has been moving up recently, shadowing movements in the 3-month T-Bill rate. That movement gave the Fed room to tighten at its last meeting (Chart 5). However, the five-year rate will soon bump against prior highs. In addition, the back half of the curve became highly correlated as it flattened (Chart 6). We believe this is a mix of market management by the Fed’s trading desk and traders anticipating actions by the Fed to prevent inversion.

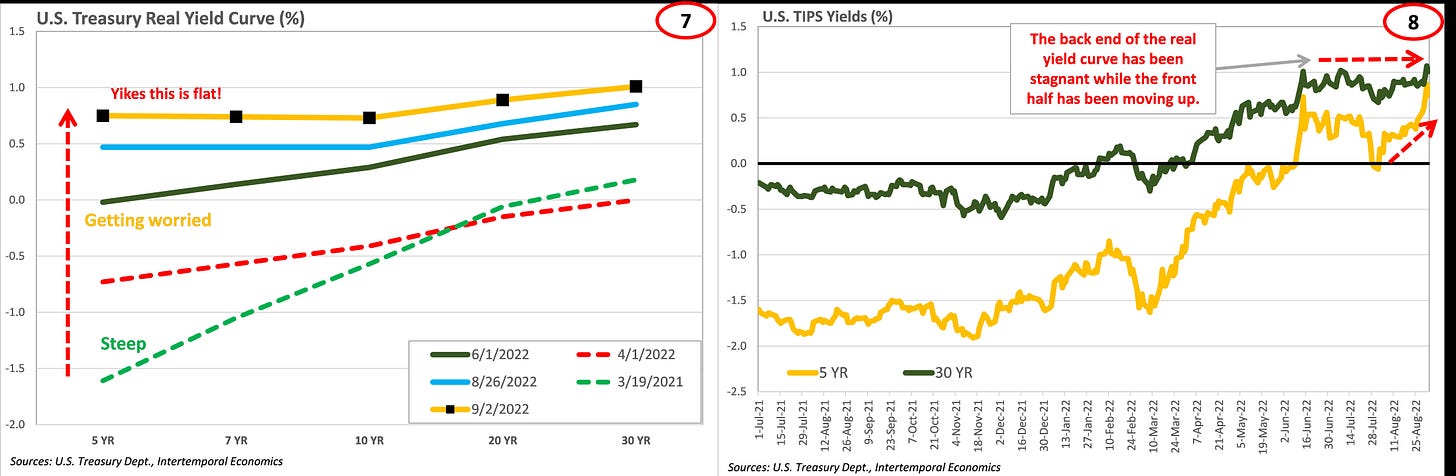

· More bad news can be found in the flattening of the real yield curve, especially over the past two months (Charts 7 & 8). This is more meaningful than a movement in the nominal curve because although financial markets focus heavily on headline yields, economic decisions are made – whether actors realize it or not - based on real yields.

· If rising real yields were able to increase nominal rates at least the Fed would have bought itself more space to tighten. Instead, rising real yields were matched by falling inflation expectations, resulting in there being a cap on nominal rates (Charts 9 & 10). Higher real rates are a good thing if the economy can sustain them, the current 30-year real rate of just under 1% is an important test for the U.S. economy.

· Gold performance has diverged from long-term real interest rates, holding up very well against rising rates, implying the gold market expect real rates to come down, which depends on inflation (Chart 11).

Commodities Corner

· The Yardini Boom-Bust Index has stabilized at elevated, but not unsustainably high levels (Chart 12). Except for the supply disruption to European natural gas, commodities markets have begun to cool off (Chart 13). In addition, the labor market has loosened recently due to high search costs.

· A surging dollar has helped to keep inflation low in the United States but has come at the cost of bottlenecks in the supply chain (Chart 14). The U.S. needs a higher savings rate, more investment, and lower consumption so a lower dollar would be better.

· The stronger dollar along with higher food prices has wreaked havoc in the developing world and emerging market equities have paid the price (Chart 15). The big downside in emerging markets to a stronger dollar is political instability due to higher food prices, and potentially a debt crisis.

· It is worth noting (again) the stabilizing effect that tight oil production in the U.S. has had on the oil market. Real prices barely breached their 2018 levels and never came close to 2014 levels (Chart 16). The bond market clearly agrees, and the 10-year has moved in step with the oil/gold ratio.

· As mentioned, natural gas markets have been experiencing a crisis since the Nordstream Pipeline became a political hostage. The oil/natural gas ratio is sinking fast as the bottleneck-driven frenzy in natural gas plays out (Chart 17).

· Interestingly, for years oil drilling has kept natural gas prices in-check because of all the byproduct associated gas generated in the frenzy to pump more oil. Now, the situation is reversed where drilling for natural gas will produce oil as a byproduct and have a depressing effect on oil prices. This is all very good news for the United States, unless the wheels come off the European economy.

· Since 2016, copper prices have exhibited a new price pattern defined by sharp upward moves that lead the oil market (Charts 18 & 19). At this point, it remains unclear if this is due to illiquidity or market manipulation. This writer will continue examining the topic.

Equity Markets

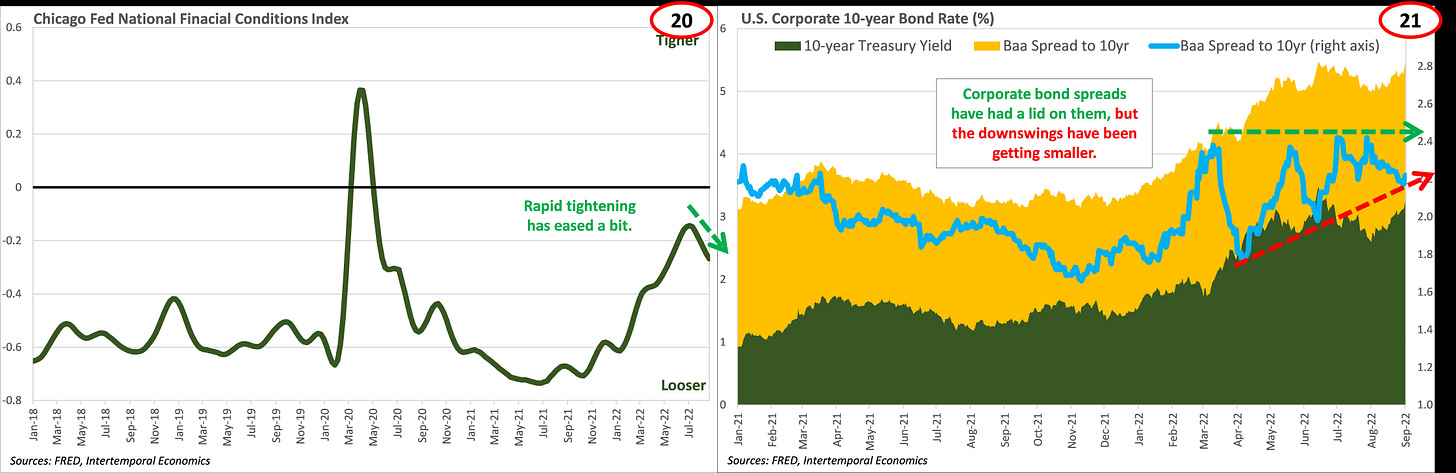

· Financial conditions have eased slightly in recent weeks but remain significantly tighter than any time since Q1 2020 (Chart 20). Curve flattening tightened conditions, so the easing of financial conditions is sentiment driven. Corporate spreads have not widened in a manner that would imply a recession but there has clearly been pressure to widen (Chart 21).

· The S&P 500 has reached an important decision point where the recent downside trend has reached a support level created by a prior channel (Chart 22). Downside momentum has eased, and the RSI is pointing approaching oversold levels. Both indicators point towards short-term bullishness so there could be a short recovery before enough downside momentum builds to break through a weak support level.

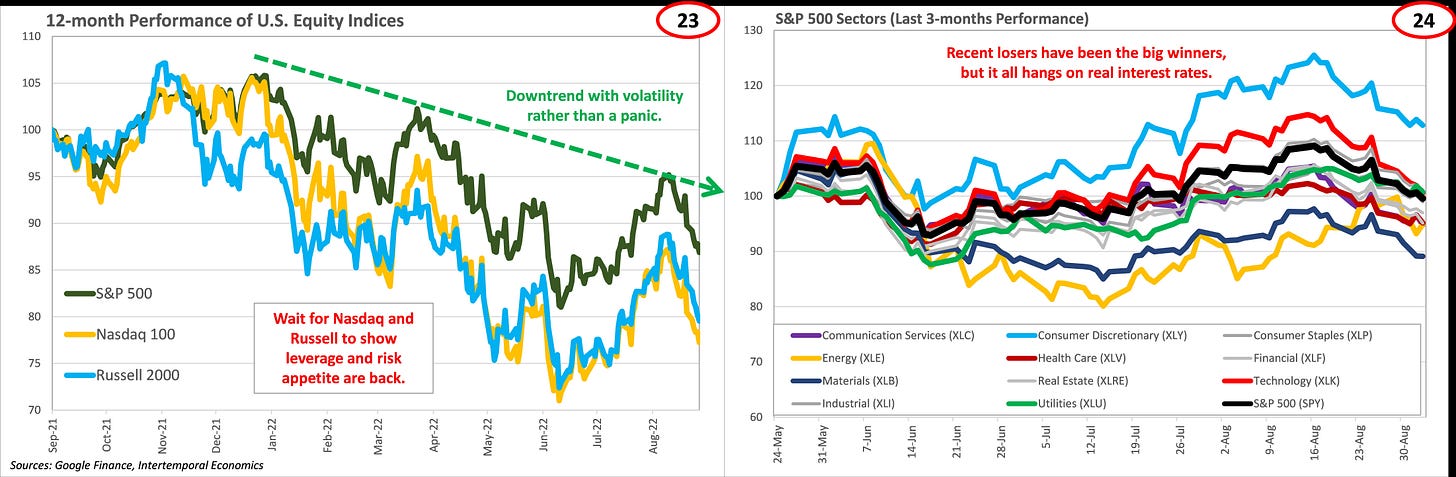

· The larger downtrend for the S&P 500 remains in place and we do not expect that downtrend to change before the Nasdaq and Russell 2000 begin to outperform (Chart 23). The current problems facing equity markets is difficulty financing and general risk aversion, which affects tech and small cap stocks more than it does the larger companies included in the S&P 500.

· Sector analysis also points toward medium-term downside for the S&P 500 as the recent winners have been the prior losers, all of which are sensitive to higher real interest rates (Chart 24).

· Companies able to fund acquisitions and/or dividends with strong internal free cash flow production, especially those in the automation industry look like the best bet in the current environment.

Excellent update! and I always love the clean, clear charts.